Bitcoin prices traded lower on Friday, and opened with a negative gap this week, following the cancellation of the much-anticipated SegWit2x hard fork. The tumble in prices was likely a reflection of market disappointment, as many investors may have purchased bitcoins ahead of the fork in order to receive the free new coins that the fork would have delivered, if implemented. The hard fork would have divided bitcoin into two coins, giving the holders of the original bitcoins extra new coins for “free”, as was the case with Bitcoin Cash and Bitcoin Gold.

Although bitcoin prices could continue correcting lower in the near-term on this negative sentiment as speculative investors rebalance their portfolios and reduce their exposure, we are not ready to turn bearish on the cryptocurrency overall. Indeed, the fact that there has been no hard fork may even prove positive for prices over time, as the fork would have created a competing version of bitcoin, which could have taken some demand out of the original instrument. In addition, there are other factors that could support bitcoin over time, such as the increased legitimacy it is slowly but surely obtaining, evident by the CME Group’s upcoming launch of a bitcoin futures exchange.

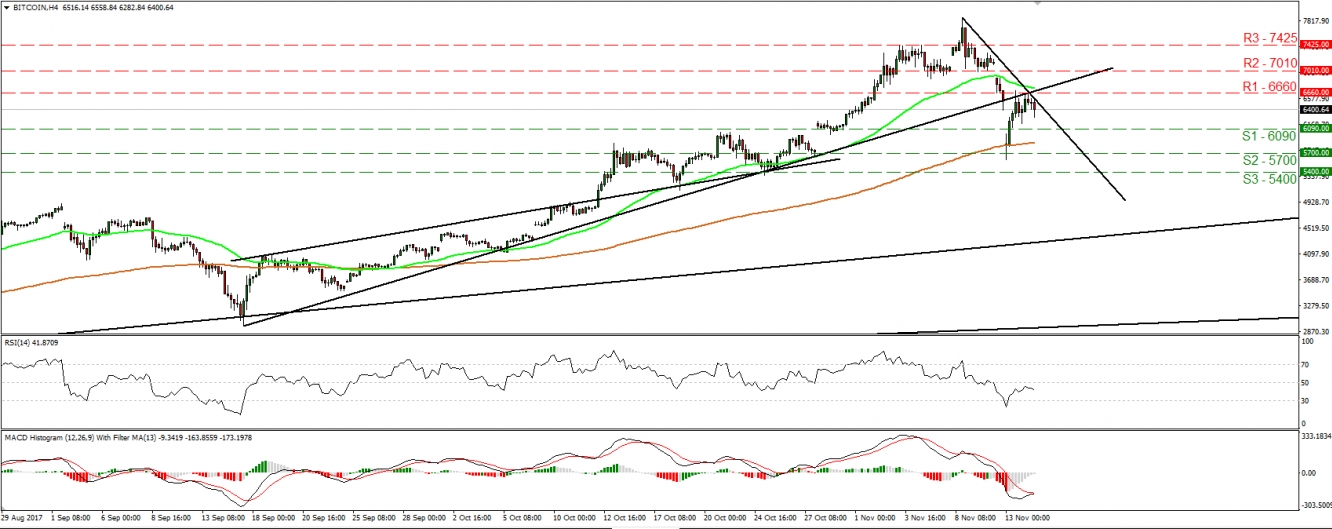

Bitcoin opened with a large negative gap on Monday, to trade fractionally below the 5700 (S2) barrier. Nevertheless, the cryptocurrency was quick to recover, close the gap, and hit resistance at 6660 (R1). Subsequently it retreated again. The price is trading below the downside resistance line taken from the peak of the 8th of November, and also below the prior uptrend line drawn from the low of the 15th of September. As such, we see the likelihood for the bears to take charge again in the short run and push the price down for another test near 6090 (S1). A clear dip below that support is possible to open the way for our next hurdle of 5700 (S2).

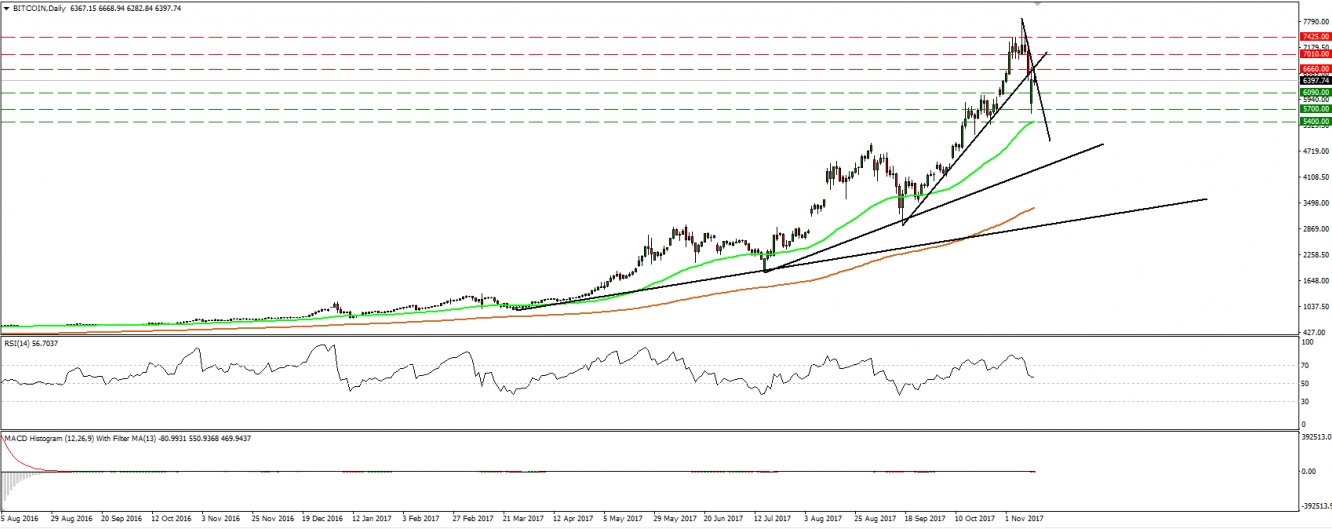

Zooming out to the daily chart, we still see a price structure of higher peaks and higher troughs. Although bitcoin has broken below the aforementioned uptrend line drawn from the low of the 15th of September, it continues to trade above other, longer-term uptrend lines, like the one drawn from the low of the 17th of July and the one taken from the lows of March. As such, we still see a positive long-term picture and we would treat the latest slide or any near-term extensions of it as a corrective phase in the context of the broader uptrend.