- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BioTelemetry (BEAT) Beats Q4 Earnings And Revenue Estimates

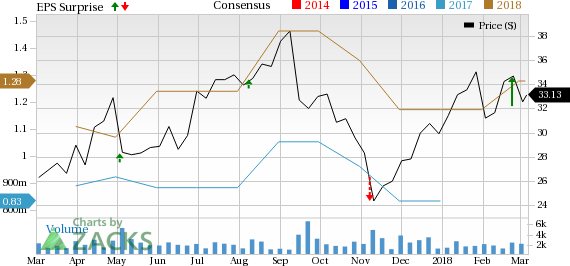

BioTelemetry Inc. (NASDAQ:BEAT) reported fourth-quarter 2017 adjusted earnings per share of 32 cents, beating the Zacks Consensus Estimate by 52.4%. Adjusted earnings per share rose 77.8% on a year-over-year basis.

Full-year adjusted earnings per share were 97 cents, up 14.1% from 2016.

Revenues in the reported quarter came in at $91.7 million, beating the Zacks Consensus Estimate by 4.2%. Revenues increased a whopping 70% on year-over-year basis (up 10% organically).

The revenue figure is a record high for BioTelemetry, also marking the 22nd straight quarter of year-over-year growth.

Full-year revenues totaled $287 million, up 37.7% from 2016 levels.

Revenue Details

The strong top-line results were backed by the acquisition of Switzerland-based LifeWatch last July. BioTelemetry realized approximately $5 million in synergies in the fourth quarter from the integration of LifeWatch and is on track to achieve $30 million of annualized synergies. The integration of LifeWatch has fortified the company’s leadership position in cardiac monitoring.

The quarter also saw stellar growth in the Mobile Cardiac Telemetry (MCT) product line, which was up 12% on a pro forma basis. Per management, MCT growth has accelerated on the acquisition of LifeWatch.

Margins

Gross margin came in at 59.3%, down 190 basis points (bps) owing to the LifeWatch and Telcare acquisitions and the Medicare rate reduction.

Operating expenses amounted to $61.74 million, thanks to surging general and administrative and sales and marketing expenses.

However, the declines have been partially offset by EBITDA of $22.9 million or 25% of revenues, which grew 80% in the fourth quarter, exceeding the company’s expectations.

Balance Sheet

BioTelemetry exited 2017 with $36 million in cash, up by $10 million in the quarter. Net debt at the end of 2017 was $204 million.

In 2017, the company generated $23.8 million in cash from operations and used $13.7 million for capital expenditures, which resulted in $10.1 million of free cash flow.

Guidance

For the first quarter of 2018, the company expects revenues in the band of $91 million to $92 million. The Zacks Consensus Estimate of $91.4 million lies within this range. EBITDA is expected at $20 million.

BioTelemetry expects to end the first quarter with about $30 million in cash.

Our Take

BioTelemetry ended the fourth quarter of 2017 on a solid note with revenues soaring to a record high. Additionally, a massive improvement in EBITDA return buoys optimism. The quarter witnessed impressive revenue growth and solid return from the MCT platform. The acquisition of LifeWatch also proved accretive. Solid guidance for the first quarter of 2018 also holds promise.

However, declining margins and surging operating expenses are discouraging. The company also registered high debts at the end of the fourth quarter, which adds to the woes.

Zacks Rank & Key Picks

BioTelemetry carries a Zacks Rank #3 (Hold).

A few top-ranked stocks that reported solid results this earnings season are athenahealth Inc. (NASDAQ:ATHN) , PetMed Express, Inc. (NASDAQ:PETS) and Centene Corporation (NYSE:CNC) . Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

athenahealth reported adjusted earnings per share of $1.11 in the fourth quarter of 2017, up 79% on a year-over-year basis. Revenues increased 14.2% to $329 million.

PetMed reported third-quarter fiscal 2018 results. Adjusted earnings per share were 44 cents, up 88.3% from the prior-year quarter. Revenues rose 13.7% to $60.1 million.

Centene reported fourth-quarter 2017 adjusted net income per share of 97 cents, beating the Zacks Consensus Estimate by 3.2%. Total revenues grew 8% to $12.8 billion from the year-ago quarter.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

athenahealth, Inc. (ATHN): Free Stock Analysis Report

BioTelemetry, Inc. (BEAT): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.