- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Best Buy (BBY) Withdraws Guidance Amid Coronavirus Crisis

In response to the increasing uncertainty and changes in operating activities amid coronavirus crisis, Best Buy Co., Inc. (NYSE:BBY) has chosen to withdraw its earlier announced guidance for first-quarter and fiscal 2021.

For fiscal 2021, management had forecasted Enterprise revenues of $43.3-$44.3 billion and Enterprise comparable sales growth of flat to up 2%. It had projected adjusted operating income rate of 4.8% and adjusted earnings per share of $6.10-$6.30 for the fiscal year. For the fiscal first quarter, management had anticipated Enterprise revenues of $9.1-$9.2 billion and comparable sales growth of flat to up 1%. It had expected first-quarter adjusted earnings per share of $1-$1.05.

Moreover, in order to strengthen its liquidity and financial flexibility during such tough times, the company drew the total amount of $1.25 billion under its revolving credit facility. This is in addition to cash and cash equivalents of roughly $2 billion as of Mar 19, 2020. Given the prevalent situation, it wise decision on the part of the company to suspend share buybacks.

Furthermore, Best Buy has been enhancing its curbside service, thus enabling customers to continue purchasing items online or via app. Meanwhile, all in-home installation and repair is suspended for the time being, while the in-home consultations are conducted virtually. The company will pay for two weeks to those employees whose hours have been eliminated, at the normal wage rate on average hours worked in the last 10 weeks.

We note that Best Buy’s online division has been gaining from higher average order values as well as increased traffic and conversion rates. Also, the Zacks Rank #3 (Hold) company’s “Building the New Blue: Chapter Two” initiative bodes well. Through this, management targets to pursue growth opportunities, better execution in key areas, cost containment, and investing in people and systems. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

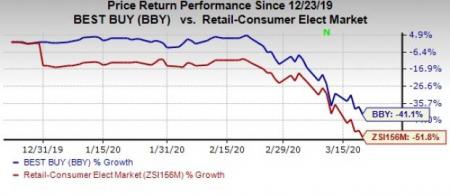

In the past three months, shares of Best Buy have tumbled 41.1%, narrower than the industry’s 51.8% decline.

Bottom Line

The novel coronavirus has been hurting most of the companies and derailing economic activities worldwide. In view of the pandemic, retailers are either shutting down stores or reducing operating hours or working remotely. Incidentally, several retailers have decided to withdraw their guidance owing to the volatile situation surrounding the deadly virus, and its impact on their performance. Likewise, retailers such as Abercrombie & Fitch (NYSE:ANF) , Nordstrom (NYSE:JWN) and American Eagle Outfitters (NYSE:AEO) withdrew their initial guidance and closed stores.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.