On Jun 28, we issued an updated research report on Berkshire Hathaway Inc. (NYSE:BRKa) BRK.B.

Given that Berkshire Hathaway is a property and casualty (P&C) insurer, it remains exposed to catastrophe losses. This in turn, negatively impacts the earnings of the company. Also, the company’s insurance underwriting results have been under pressure owing to high cat losses.

The P&C insurer’s most important non-insurance subsidiary Burlington Northern SantaFe Corp. (BNSF) continues to incur capital expenditure to improve its performance. The company anticipates incurring $6.6 billion in capital expenditure in 2016, owing to its railroad operations. Such a massive capital expenditure will drain the segment’s margin over the coming quarters.

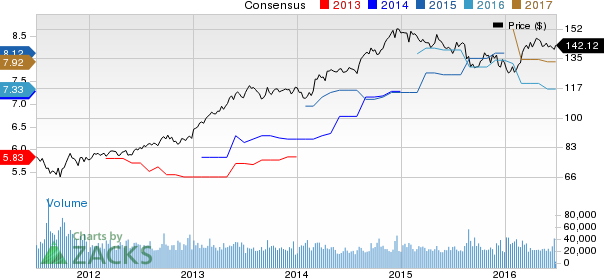

Further, The Zacks Consensus Estimate has been revised downward in the last 60 days for both 2016 and 2017. With respect to earning trends, the P&C insurer missed expectations in three of the last four quarters.

Nevertheless, the company’s inorganic growth story seems impressive and is expected to be accretive to earnings in the future. To that end, the company recently announced its decision to buy stakes in Apple Inc. (NASDAQ:AAPL) . Also, in the first quarter the company increased its holdings in Visa Inc. (NYSE:V) and The Bank of New York Mellon Corporation (NYSE:BK) .

Moreover, a robust capital position adds to the overall strength of the company.

The Zacks Consensus Estimate for the second quarter is currently pegged at $1.85. Our proven model does not conclusively show that the company is likely to beat estimates this quarter. This is because Zacks Rank #4 (Sell) coupled with an Earnings ESP of 0.00% makes prediction difficult.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

BANK OF NY MELL (BK): Free Stock Analysis Report

APPLE INC (AAPL): Free Stock Analysis Report

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

VISA INC-A (V): Free Stock Analysis Report

Original post

Zacks Investment Research