Cryptocurrencies are at a crossroad right now with countries like China that sees cryptocurrencies as a disturbance and wants to rapidly regulate or even forbid new ICOs and other countries where digital moneys are the future and where a free and unregulated market is an opportunity to develop and improve the technology and security of cryptocurrencies.

With so much mixed signals from various countries, cryptos' investors are really confused and react rapidly to every news and rumors that come.

Fundamental analysis is sometime overwhelming with so many contradictory information. So let see what a little of technical analysis tells us.

As analyzed in our last post, the downtrend we expected as materialized last week with a drop of more than $1250 at one point last week for Bitcoin and more than $100 for Ether. Since then both have regained some of the losses but what can we expect in the days and weeks to come?

Let see technically with our eGOLDfx algorithm what's going on:

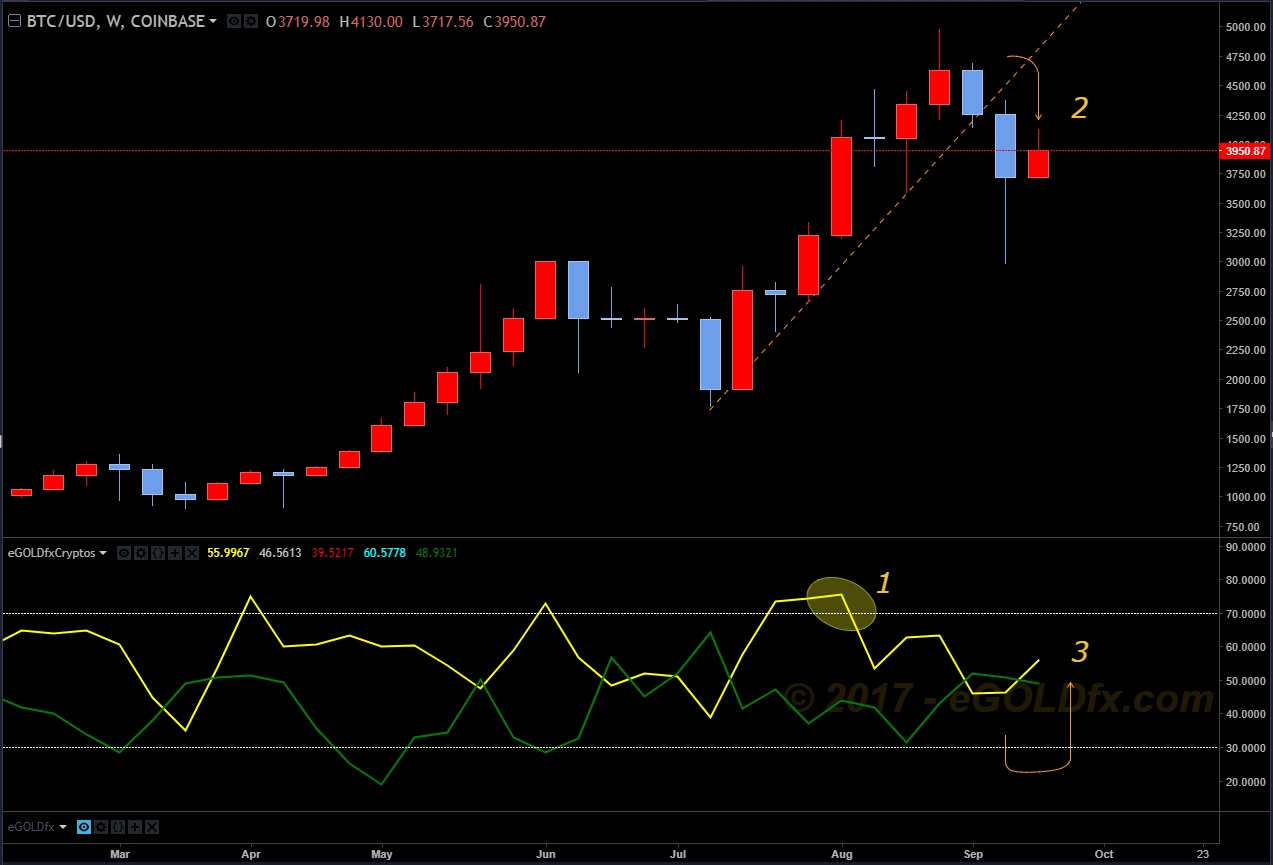

1. The eGOLDfx meter has reached the Strong area above 70

2. Then the uptrend line was broken and thus price plunged confirming an new downtrend.

3. In order to have a new uptrend, we will need to have the Bitcoin strenght line (yellow) to go below 30 or the USD strength line (green) to go above 70 on the eGOLDfx algorithm. Until then the medium term trend remains down.

1. The eGOLDfx meter has reached the Strong area above 70

2. Then the uptrend line was broken and thus price plunged confirming an new downtrend.

3. In order to have a new uptrend, we will need to have the Ether strenght line (yellow) to go below 30 or the USD strength line (green) to go above 70 on the eGOLDfx algorithm. Until then the medium term trend remains down.

4. The double top formation is still in effect indicating a great potential for a large move down.

Let see how it turns out.