- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AVEO Pharmaceuticals' (AVEO) Q4 Earnings: What's In Store?

AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) is expected to report fourth-quarter 2017 results on Mar 28.

Last quarter, AVEO delivered a positive surprise of 60%.

The company significantly outperformed the industry last year. The stock surged 207.1% against a decline of 2.8% for the industry.

Let’s see how things are shaping up for this quarter.

Factors at Play

In November 2017, AVEO launched Fotivda in Europe starting with Germany, making the drug its first commercial product. The company will receive double-digit royalty payments from EUSA Pharma on net sales of the drug in Europe. However, the impact on the top line remains to be seen.

In August 2017, the European Commission approved Fotivda (tivozanib) for treating first-line treatment for renal cell carcinoma (“RCC”) in adults. The drug has demonstrated superiority over Bayer’s Nexavar in treating RCC.

In October 2017, AVEO announced results of a pre-planned futility analysis of phase III TIVO-3 study comparing Fotivda to Bayer’s Nexavar as treatment for patients with refractory advanced RCC. Based on the results, the company will continue the study unmodified. The data from this study along with previously completed TIVO-1 study will support the regulatory application for approval in the United States.

In December 2017, the company announced completion of enrollment in phase II portion of phase I/II TiNivo study evaluating Fotivda in combination with Bristol-Myers’ (NYSE:BMY) Opdivo in RCC.

Apart from Fotivda, AVEO is also developing ficlatuzumab in combination with Lilly’s Erbitux in a phase II study for treating metastatic head and neck squamous cell carcinoma. Another phase Ib study is evaluating the candidate in combination with Nab-paclitaxel and Gemcitabine in treatment-naive pancreatic cancer. These studies were initiated during the quarter.

We expect research & development expenses to increase in the quarter due to initiation of ficlatuzumab studies and continuation of TIVO-3 study.

Investor focus will likely remain on updates related to Fotivda’s launch and progress of ficlatuzumab.

Surprise History

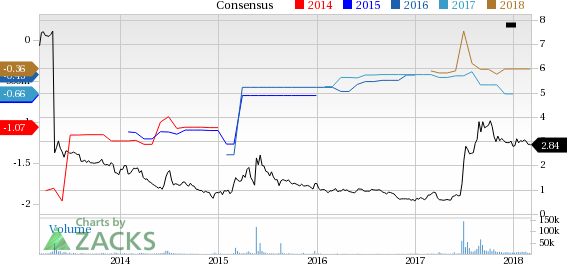

AVEO’s performance over the last four quarters has been mixed with the company surpassing expectations thrice and missing once with an average positive surprise of 16.37%.

Earnings Whispers

Our proven model does not conclusively show that AVEO is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates. But that is not the case here, as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00% with both pegged at a loss of 3 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Although AVEO’s Zacks Rank #3 increases the predictive power of ESP, its 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a couple of health care stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Celldex Therapeutics, Inc. (NASDAQ:CLDX) is scheduled to release results on Mar 7. The company has an Earnings ESP of +18.28% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gemphire Therapeutics (NASDAQ:GEMP) is expected to release results on Mar 21. The company has an Earnings ESP of +24.74% and a Zacks Rank #2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Celldex Therapeutics, Inc. (CLDX): Free Stock Analysis Report

AVEO Pharmaceuticals, Inc. (AVEO): Free Stock Analysis Report

Gemphire Therapeutics Inc. (GEMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.