- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

Autoliv (ALV) To Embark On Electronics Business Listing

Autoliv, Inc. (NYSE:ALV) announced that its board has completed its planned review of the company’s operational efficiency and has decided to move forward with the public listing of the company’s Electronics business segment. The listing is expected to conclude by the third quarter of 2018.

Autoliv’s Electronics business is one of the two operating segments within the company that offers restraint control, sensing and brake systems.

While the other segment is called Passive Safety, offering airbag systems, steering wheels and seatbelts.

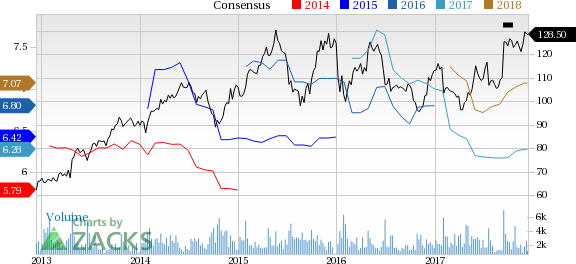

Autoliv, Inc. Price and Consensus

In September, the company had informed to conduct a strategic evaluation of its operating structure and look into the possibilities of creating a separate entity with the Electronics business unit.

The key factors behind this spin-off decision include varying technological advancements and skill set needs, different sales growth rates, market requirements etc.

Per the spin-off, the Electronics business segment is anticipated to receive cash investments from the parent company in order to retain Autoliv’s investment grade.

The spin-off company is likely to be listed in both the United States and Sweden. Moreover, Autoliv’s Passive Safety segment would operate under the company’s name post the spin-off and it will continue to trade on the New York Stock Exchange and Nasdaq Stockholm.

Price Performance

In the last 30 days, shares of Autoliv have outperformed the industry it belongs to. The stock has gained 4.5% compared with the industry’s decline of 0.6% during the period.

Zacks Rank & Key Picks

Autoliv carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are American Axle & Manufacturing Holdings (NYSE:AXL) , Oshkosh Corporation (NYSE:OSK) and AB Volvo (OTC:VLVLY) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

American Axle has an expected long-term growth rate of 8.1%. In the last three months, shares of the company have been up 8.3%.

Oshkosh has an expected long-term growth rate of 16.5%. In the last three months, shares of the company rallied 16.4%.

Volvo has an expected long-term growth rate of 15%. Year to date, shares of the company have soared 63%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Autoliv, Inc. (ALV): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

Volvo Ab (VLVLY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.