by Eli Wright

With President Trump continuing to clash with US lawmakers over his proposed immigration ban, France's April presidential election campaign heating up and the UK parliament beginning its 3-day debate today over legislation giving PM Theresa May the power to trigger Article 50 and begin Brexit in earnest, key global market drivers will likely be political as the trading week begins.

Early Sunday morning, the Ninth Circuit Court of Appeals denied a request from the Justice Department to restore Trump's executive order after a federal judge in Seattle issued a restraining order on Friday saying the ban could not be enforced. Also yesterday, France’s far-right leader Marine Le Pen officially declared her candidacy, delivering a speech attacking globalization and immigration, and promising a referendum on EU membership – what's come to be known as Frexit.

This morning, as Article 50 negotiations begin in the UK, Prime Minister May could face opposition from several of her own party members who want to stop what they term a 'disastrous' hard Brexit. Additionally, according to a recent poll of UK business leaders, "58% percent believe their business is already suffering from the UK's decision to leave the European Union."

Overnight in Asia, equities saw modest gains. The Nikkei rose 0.31%, to 18,976.71; the Shanghai Composite finished 0.55% higher, at 3,157.37; and the Hang Seng gained 0.9%, to 23,338.

In Europe, markets are mixed. The FTSE is clinging to a 0.11% gain, at 7,196.25. However the DAX is down 0.54% at 11,588; and the Stoxx 50 is 0.35% lower, at 3,266.50.

On Wall Street, major indices finished higher on Friday propelled by Trump's executive order to roll back Dodd-Frank regulations. The Dow crossed back over the 20K line, up 0.94% to 20,071.46; the S&P 500 gained 0.73%, to 2,297.42; and the NASDAQ closed up 0.54%, at 5,666.77. Both the NASDAQ and NASDAQ 100 are now close to new all-time highs.

In pre-market trading, however, the Dow is flat; the S&P is down 0.04%, and the NASDAQ has slipped 0.11%.

US Treasurys have fallen across the board: the 2-year yield is 1.185%; the 10-year yield is 2.452%; and the 30-year yield is 3.084%.

Forex

Despite Friday’s US jobs report showing disappointing wage growth and an uptick in unemployment, the headline number showed 227K new jobs, which has contributed to this morning’s dollar gain. The greenback is currently up 0.1% at 99.96. However, longer term, its outlook is testing bullish stamina.

Also playing a part in today’s stronger dollar is the weaker euro, which has fallen 0.41% to 1.0739 after Germany’s Finance Minister Wolfgang Schaeuble said over the weekend that the single currency’s exchange rate is too low. ECB President Mario Draghi is speaking this morning and might have a response.

The pound is down 0.02%, to 1.248. Downside support could be found at 1.2375 with the first line of resistance is at 1.265.

The yen is stronger this morning, up 0.21%, to 112.41. Trump has criticized Japan for benefiting from its devalued currency at the expense of the United States. However, Former Japanese Vice Minister of Finance Eisuke Sakakibara stated that he could see the possibility of the dollar falling below 100 yen by the end of 2017.

The Mexican peso is up 0.2%, at 0.0492 right now, having gained more than 8% since President Trump’s inauguration. With some of the worst anti-Mexico action from the US president possibly already priced in, the peso could rise above 0.05. Downside support can be found at 0.0482.

Commodities

Crude oil has ticked up 0.3% this morning, to $53.99, while Brent is 0.16% higher, at $56.90. Despite rising US crude inventories and an increasing number of oil rigs weighing on prices, the commodity appears to be receiving some support because of tensions between the USA and Iran, after the Persian nation launched a ballistic missile test late last week and the United States responded with sanctions against individuals and firms involved in helping Iran with their ballistic missile technology.

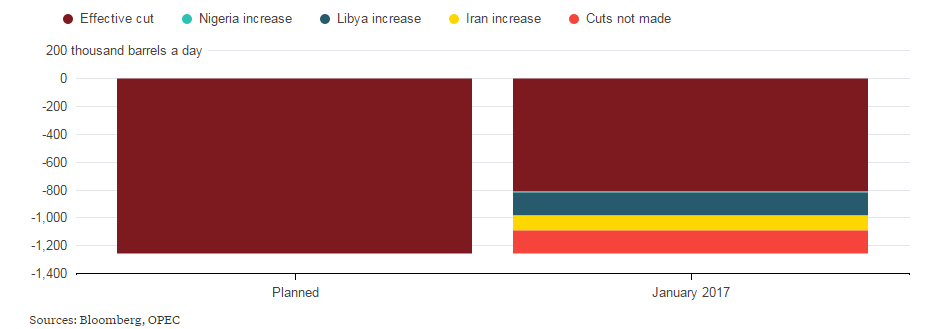

It's still not clear whether OPEC cuts will help prices. Following their pledge to reduce output by 1.2 million bpd, some cartel members, including Saudi Arabia and Qatar have cut more than their assigned quotas. Other members, however, have only partly implemented the cuts. Add in Iran, Libya, and Nigeria, which were left out of the deal completely, and OPEC has only limited production by 800,000 bpd.

Gold has rallied to a 12-week high this morning, up 0.35%, at $1,225.05. Silver is 0.62% higher at $17.59. Nevertheless, some believe that risk-on sentiment continues to drive markets, and any gold rally will ultimately stall in the near-term.

Stocks

Among large-caps reporting earnings today:

- Media and entertainment corporation Twenty-First Century Fox (NASDAQ:FOX) is slated to report Q2 2017 earnings per share of $0.49 on revenue of $7.51 billion.

- Foodservice distributor Sysco (NYSE:SYY) is expected to report Q2 2017 EPS of $0.54 on $12.14 billion in revenue.

- Newell Brands (NYSE:NWL), which designs, sources and distributes a wide range of consumer and commercial products from Sharpie markers to Rubbermaid containers, is set to report Q4 2016 earnings per share of $0.80 on revenue of $10.07 billion.

- Toy and game manufacturer Hasbro (NASDAQ:HAS) is expected to report Q4 2016 EPS of $1.27 on $1.52B in revenue.

Without doubt today's biggest water-cooler topic will be last night's astounding Super Bowl, with its historic, come-from-behind Patriots' victory. Along with the game itself, commercials aired will be in focus. According to Kenneth Kim, writing last year in Forbes magazine, when a given company’s Super Bowl commercial was well received, its shares often saw a price-bump on the following day.

If that's the case, some of yesterday’s high-profile commercials could see some movement today. Favorites included:

- Wix.com's (NASDAQ:WIX) ad starring Wonder Woman Gal Gadot and Jason Statham.

- Budweiser’s commercial, which introduced viewers to the immigrant founder of Anheuser Busch (NYSE:BUD), the beer’s parent company.

- Intel's (NASDAQ:INTC) ad starring Super Bowl MVP Tom Brady.

- Bai juice’s 30-second spot featuring Justin Timberlake and Christopher Walken. The beverage is a product of Dr Pepper Snapple Group (NYSE:DPS).