After five years of gold production via both gravitational and heap leach recovery methods, Auriant Mining's (ST:AURIM) Tardan plant is now being remodelled to a single carbon-in-leach (CIL) process flow route, which is expected to improve metallurgical recoveries by c 31% and halve total cash costs to c US$523/oz. At the same time, Auriant is also completing a definitive feasibility study (DFS) on its greenfields Kara-Beldyr prospect. Combined, the two are expected to achieve management’s goal of 3,000kg (or 96,453oz) of gold output per year from FY22 (vs 809.5kg, or 26,049oz, in FY17), when the company is forecast to achieve an EBITDA of US$52.7m.

Western management and Auriantal nous

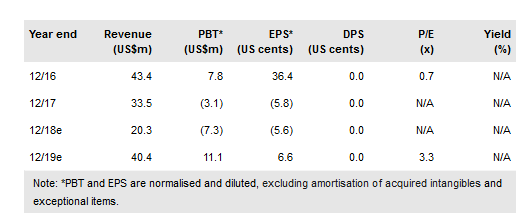

Auriant had net debt of US$70.2m as at end-FY17, after its Q317 rights issue and management has indicated that it believes that it will require c US$17.2m in cash funding from equity sources for it to bring the Tardan CIL project into production (initial capex US$12m) and to complete a DFS on Kara-Beldyr (cost c US$2m), after which initial capex (US$75m) will be financed via internal cash flows and additional debt funding. Assuming that the company raises cash proceeds of SEK68.4m (US$8.3m) in equity funding in Q118 – either via the exercise of warrants or a conventional equity raise (see page 18) – and an additional SEK74.1m (US$9.0m) in late FY18/early FY19, we would anticipate the maximum net debt level required to fund the company’s expansion to be US$97.8m in FY21 (equating to a leverage ratio of 82.5%), before declining thereafter.

To read the entire report Please click on the pdf File Below: