Here are four stocks with buy rank and strong income characteristics for investors to consider today, July 8th:

Best Buy Co (NYSE:BBY)., Inc. (BBY): This retailer of technology products, services, and solutions has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.4% over the last 60 days.

Best Buy Co., Inc. Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 2.78%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.61%.

Best Buy Co., Inc. Dividend Yield (TTM)

Arbor Realty Trust, Inc. (ABR): This real estate investment trust (REIT) has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.1% over the last 60 days.

Arbor Realty Trust Price and Consensus

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 9.08%, compared with the industry average of 4.31%. Its five-year average dividend yield is 8.61%.

Arbor Realty Trust Dividend Yield (TTM)

Capitala Finance Corp. (CPTA): This business development company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2% over the last 60 days.

Capitala Finance Corp. Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 10.35%, compared with the industry average of 8.91%. Its five-year average dividend yield is 12.21%.

Capitala Finance Corp. Dividend Yield (TTM)

Atlantica Yield plc (AY): This owner and manager of renewable energy, natural gas power, electric transmission lines and water assets has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.1% over the last 60 days.

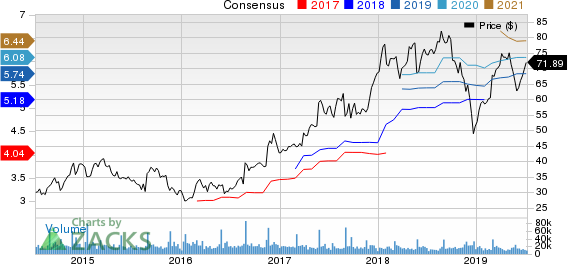

Atlantica Yield PLC Price and Consensus

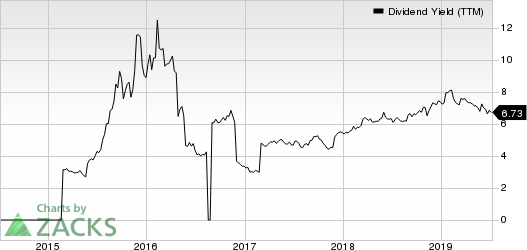

This Zacks Rank #2 (Buy) company has a dividend yield of 6.73%, compared with the industry average of 2.89%. Its five-year average dividend yield is 5.36%.

Atlantica Yield PLC Dividend Yield (TTM)

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Capitala Finance Corp. (CPTA): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Atlantica Yield PLC (AY): Free Stock Analysis Report

Arbor Realty Trust (ABR): Free Stock Analysis Report

Original post

Zacks Investment Research