When I take a look at the two “commodity currencies” of Australia and Canada, I see several similarities. Both countries have large Asian populations and have benefited from rampant house price inflation over many years. Both countries have also had their moments of strong growth which has been based on robust commodity markets and exports. And in recent months, both countries have suffered as a result of externalities, namely a Chinese economic slowdown in the case of Australia and a collapse in the oil price for Canada. It is unsurprising to me that the longer-term monthly chart shows a currency pair in AUD/CAD that oscillates very broadly between 0.91 and 1.06. The pair is currently trading at 0.9575.

And within this range, I feel that the risk/reward favors a long AUD/CAD trade. I say so for the following reasons.

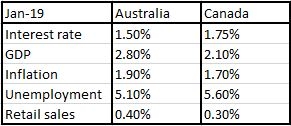

1. The data stacks up in favor of Australia

Australia beats Canada on all fronts with regards to GDP, inflation, employment and retail sales. These are key metrics that Central Banks use when appraising their interest rate policy.

2. Last week the Bank of Canada kept interest rates on hold

The Canadian dollar rallied last week before the announcement, but the BoC (perhaps because the Fed is likely to relax the pace of US interest rates) kept interest rates on hold at 1.75%. Now that the decision has been printed, I expect the CAD rally to fade away. The RBA, despite very solid data, has been reluctant to raise interest rates when perhaps they should have done, citing concerns about falling house prices and wage growth. I expect the next GDP reading in Australia to be higher than 2.8% and I expect Australia to raise interest rates before Canada.

3. The oil price has taken a spectacular hit since the beginning of October and will stay relatively low

AUD/CAD rallied almost simultaneously with the fall in the price of oil. If oil stays weak, it will further impact the Canadian dollar.

4. The US and China will come to some sort of an agreement

This I feel will give the Australian dollar a boost in general. It is quite clear that both sides are holding out for a deal and for the most part, Mr. Trump’s hardline approach is more about his image and media coverage. The Chinese are tough and resilient negotiators. It is in the World’s interest that this issue is solved, and it will be!

My view is that there is solid support at 0.9250 that will protect a long term AUD/CAD trade. Political and economic factors will give a boost to the Australian dollar. I am looking for the currency pair to gradually rise above parity and my target is 1.0050 which is roughly 5 % higher than current levels.