Acorda Therapeutics, Inc. (NASDAQ:ACOR) reported second-quarter 2019 loss per share of 55 cents, narrower than the Zacks Consensus Estimate of a loss of $1.06. However, the figure came in against the year-ago earnings of $1.40.

Meanwhile, the company generated total revenues of $50.1 million in the second quarter, comprehensively beating the Zacks Consensus Estimate of $26.2 million. However, sales tumbled 67.3% year over year due to lower sales of multiple sclerosis (MS) drug Ampyra.

Shares of Acorda have plunged 61% so far this year, outperforming the industry’s decrease of 0.4%.

Quarter in Detail

Inbrija generated sales of $3 million in the reported quarter, reflecting a significant sequential increase.

Notably, last December, the FDA approved Acorda’s Parkinson's disease (PD) drug Inbrija. Following this nod, the product became the first and the only approved inhaled levodopa for treating OFF periods in patients suffering Parkinson’s and receiving a carbidopa / levodopa regimen. Inbrija was launched in February this year.

Last month, the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) rendered a positive opinion recommending the approval of Inbrija in Europe. A final decision is expected by the end of 2019.

The company believes that Inbrija sales will pick up in the future quarters, having received an encouraging feedback, both from doctors and patients since its launch. An approximately 4,500 prescription request forms for Inbrija were received through July 2019.

Although majority of Acorda’s net product revenues were drawn from the company’s MS drug Ampyra, which raked in sales of $44.2 million in the quarter, the sales figure nonetheless suffered a huge 70.6% slump year over year due to generic competition. However, sales improved 10.2% sequentially. On a positive note, Ampyra sales were higher than the company’s internal projections in the second quarter because sales erosion due to generic launches was less severe.

Last September, Ampyra lost its exclusivity as generics entered the market including Mylan's (NASDAQ:MYL) authorized generic version. Consequently, Acorda believes that Ampyra sales will see a sharp decline in the quarters ahead in 2019.

Meanwhile, royalty revenues were $2.8 million in the quarter, almost in line with the year-ago reported figure.

Acorda’s research and development (R&D) expenses (excluding share-based compensation expenses) were $18.2 million, down 25.4% year over year.

Selling, general and administrative (SG&A) expenses (excluding share-based compensation expenses) were $46.7 million, up 15% year over year.

Acorda had $296.9 million cash, cash equivalents and investments as of Jun 30, 2019 compared with $343.3 million as of Mar 31, 2019.

We would like to remind investors that the successful commercialization of Inbrija is imperative for long-term growth at Acorda, especially as generic competition looms large on Ampyra. Although Inbrija is off to a promising start, it still remains to be seen if the product can deliver the desired results and be a worthy replacement for Ampyra in the long run.

Notably, more than 350,000 people in the United States are suffering OFF periods related to Parkinson’s disease. Acorda estimates Inbrija’s market opportunity to be more than $800 million in the United States.

2019 Guidance

Acorda expects Ampyra revenues to exceed $140 million for the full year. Previously, the company decided not to provide any outlook for Ampyra due to its waning revenues, induced by the entrance of generics.

The company expects full-year R&D and SG&A expenses (excluding share-based compensation) in the band of $70-$80 million and $200-$210 million, respectively.

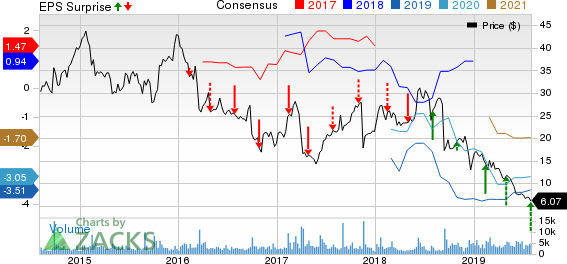

Acorda Therapeutics, Inc. Price, Consensus and EPS Surprise

Zacks Rank & Other Stocks to Consider

Acorda currently sports a Zacks Rank #1 (Strong Buy). Other top-ranked stocks from the healthcare sector include Merus N.V. (NASDAQ:MRUS) and Repligen Corporation (NASDAQ:RGEN) , both carrying a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Merus’ loss per share estimates have been narrowed 9.1% for 2019 and 9.2% for 2020 over the past 60 days. The stock has rallied 15.2% so far this year.

Repligen’s earnings estimates have been revised 4.3% upward for 2019 and 3.6% for 2020 over the past 60 days. The stock has soared 81.1% year to date.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Acorda Therapeutics, Inc. (ACOR): Free Stock Analysis Report

Merus N.V. (MRUS): Free Stock Analysis Report

Repligen Corporation (RGEN): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post