- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Glacier Bancorp (GBCI) Announces Dividend Hike: Worth A Look?

Glacier Bancorp, Inc. (NASDAQ:GBCI) has raised its quarterly common stock dividend by about 3.8% to 27 cents per share. The dividend will be paid on Jul 18, to shareholders of record as of Jul 9, 2019. Notably, this is the 44th time that the company has increased its dividend.

Glacier Bancorp’s robust business model highlights the company’s commitment toward returning value to shareholders with its strong cash-generation capabilities. Prior to this revision, the company had raised its quarterly dividend to 26 cents per share last June, marking a 13% hike.

Considering last day’s closing price of $39.56 per share, the dividend yield is currently valued at 2.73%.

Investors interested in this Zacks Rank #2 (Buy) stock can have a look at the bank’s fundamentals and growth prospects. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Strong Organic Growth: Glacier Bancorp’s revenues witnessed 10.8% compounded annual growth rate (CAGR) over the last five years, ending 2018. The company’s projected sales growth (F1/F0) of 12.29% highlights continued upward momentum in revenues.

Earnings Per Share Strength: The banking firm has witnessed earnings growth of 8.38% over the last three-five years. This earnings momentum is likely to continue in the near term as reflected by the company’s projected earnings per share (EPS) growth rate (F1/F0) of 11.98%. Additionally, the company’s long-term (three-five years) estimated EPS growth rate of 10% promises rewards for investors over the long run.

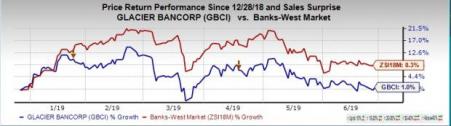

Share Price Movement: Glacier Bancorp’s shares have gained around 1% in the past six months compared with 8.3% growth recorded by the industry.

Superior Return on Equity (ROE): Glacier Bancorp’s ROE of 12.83%, compared with the industry average of 11.8%, indicates the company’s commendable position over its peers.

Some other finance stocks which raised their dividends during the current quarter include Lazard Ltd. (NYSE:LAZ) , Main Street Capital Corporation (NYSE:MAIN) and First Midwest Bancorp (NASDAQ:FMBI) . Lazard raised its quarterly dividend by 7%, while First Midwest Bancorp increased by 17%. Also, Main Street Capital has announced a 2.5% rise in its common stock dividend.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

First Midwest Bancorp, Inc. (FMBI): Free Stock Analysis Report

Glacier Bancorp, Inc. (GBCI): Free Stock Analysis Report

Lazard Ltd (LAZ): Free Stock Analysis Report

Main Street Capital Corporation (MAIN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

The price-to-earnings (P/E) ratio is one of the most commonly used metrics to determine whether a stock is expensive or cheap. Generally, the higher the P/E ratio, the more...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.