IHS Markit Ltd. (NASDAQ:INFO) reported mixed second-quarter fiscal 2019 results with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings per share of 71 cents beat the consensus mark by 6 cents and increased 16.4% on a year-over-year basis. Total revenues came in at $1.14 billion, missing the consensus mark by a slight margin but improving 12.6% from the year-ago quarter.

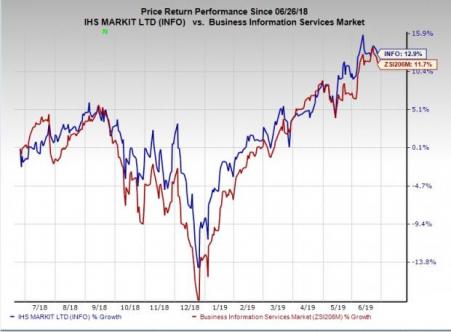

We observe that shares of IHS Markit have gained 12.9% over the past year, outperforming 11.7% rally of the industry it belongs to.

Quarter Details

Revenues at the Resources segment totaled $249.4 million, up 5% year over year, with recurring revenues rising 4% organically. The Transportation segment experienced year-over-year revenue growth of 8% to reach $318.6 million. Recurring revenues at this segment grew 10% organically.

Revenues at the CMS segment amounted to $134.6 million, down 3% year over year, with no organic growth in recurring revenues. Financial services segment’s revenues increased 29% year over year to $432.9 million with recurring revenues increasing 4% organically.

Recurring fixed revenues of $785.2 million rose 12% year over year on a reported basis and 5% on an organic basis. Recurring variable revenues grew 15% year over year to $145 million. Non-recurring revenues totaled $205.3 million, up 11% year over year on a reported basis and 9% on an organic basis.

Adjusted EBITDA of $465 million increased 16.8% from the year-ago quarter. Adjusted EBITDA margin improved 150 points (bps) year over year to 41%.

IHS Markit ended the quarter with cash and cash equivalent balance of $109.5 million compared with $133.2 million in the prior quarter. Long-term debt was $4.9 billion compared with $5.1 billion in the previous quarter.

Cash flow from operations and free cash flow amounted to $424.7 million and $358 million, respectively, in the quarter. The company spent $66.7 million in capex.

Fiscal 2019 Outlook

IHS Markit reiterated its fiscal 2019 guidance. Revenues are expected in the range of $4.425 billion to $4.500 billion, including organic growth of 6% to 7% (including Ipreo). The Zacks Consensus Estimate for revenues is pegged at $4.45 billion. Adjusted EBITDA is expected in the range of $1.75 billion to $1.78 billion. Adjusted EPS is anticipated in the range of $2.52 to $2.57. The Zacks Consensus Estimate is pegged at $2.55.

Zacks Rank & Stocks to Consider

IHS Markit currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the broader Zacks Business Services sector are Navigant Consulting (NYSE:NCI) , NV5 Global (NASDAQ:NVEE) and FLEETCOR Technologies (NYSE:FLT) . While Navigant Consulting sports a Zacks Rank #1, FLEETCOR and NV5 Global carry a Zacks Rank #2 (Buy).

Long-term expected EPS (three to five years) growth rate for Navigant Consulting, FLEETCOR and NV5 Global is 13.5%, 15.4% and 20%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

IHS Markit Ltd. (INFO): Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT): Free Stock Analysis Report

NV5 Global, Inc. (NVEE): Free Stock Analysis Report

Navigant Consulting, Inc. (NCI): Free Stock Analysis Report

Original post

Zacks Investment Research