For the 24 hours to 23:00 GMT, the EUR declined 0.3% against the USD and closed at 1.1738, following the release of downbeat ZEW economic sentiment data across the Euro-zone.

The Euro-zone’s ZEW economic sentiment index declined to a level of 29.0 in December, after recording a reading of 30.9 in the prior month.

Additionally, mood among German investors eased more-than-anticipated to a level of 17.4 in December, dropping for the first time in four months, hurt by heightened political uncertainty as the Euro-bloc’s largest economy is struggling to forge a new government. The index had registered a reading of 18.7 in the previous month, while markets were expecting it to fall to a level of 18.0. On the other hand, the nation’s ZEW current situation index unexpectedly climbed to a level of 89.3 in December, notching its highest since July 2011. The index had posted a level of 88.8 in the previous month, while investors had anticipated for a fall to a level of 88.7.

In the US, macroeconomic data indicated that producer prices advanced 3.1% on an annual basis in November, rising by the most since January 2012 and boosting hopes that price pressures may pick-up. Market participants had envisaged the index to gain 2.9%, following a rise of 2.8% in the previous month. Moreover, the nation’s NFIB small business optimism index climbed to a level of 107.5 in November, surpassing market consensus for a rise to a level of 104.0 and following a reading of 103.8 in the prior month.

Other data indicated that the US budget deficit surprisingly widened to $138.5 billion in November, confounding market expectations for it to narrow to $134.5 billion and compared to a deficit of $136.7 billion in the prior month.

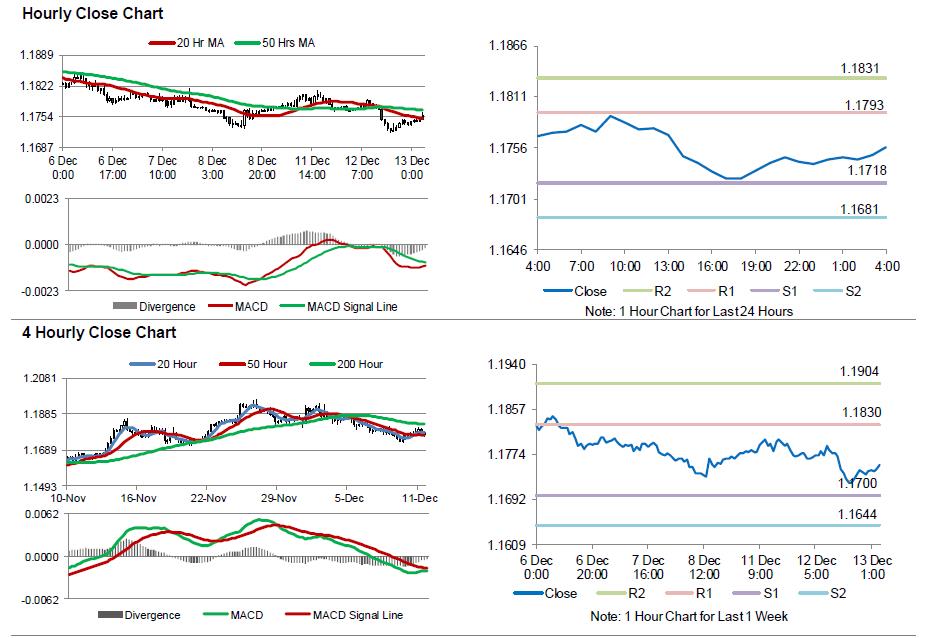

In the Asian session, at GMT0400, the pair is trading at 1.1756, with the EUR trading 0.15% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1718, and a fall through could take it to the next support level of 1.1681. The pair is expected to find its first resistance at 1.1793, and a rise through could take it to the next resistance level of 1.1831.

Moving forward, investors would focus on the Euro-zone’s industrial production data for October and Germany’s final inflation figures for November, both slated to release in a few hours. Later in the day, all eyes will be on the Federal Reserve’s (Fed) interest rate decision, wherein the central bank is widely expected to raise its key interest rates. Moreover, the US consumer price index for November, scheduled to be released later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.