- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Highwoods Properties' (HIW) Q3 FFO Beats, Outlook Improved

Highwoods Properties Inc. (NYSE:HIW) reported third-quarter 2017 funds from operations (FFO) of 86 cents per share, beating the Zacks Consensus Estimate by a penny. It also compares favorably with the year-ago tally of 82 cents.

Results indicate strong leasing metrics and robust growth in straight-line rental income.

Total revenues for the quarter jumped 8.4% year over year to $180 million. In addition, the figure surpassed the Zacks Consensus Estimate of $178 million.

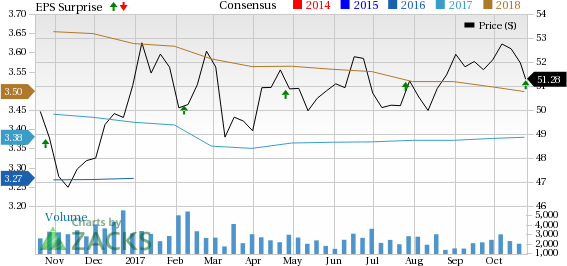

Highwoods Properties, Inc. Price, Consensus and EPS Surprise

Note: The EPS numbers presented in the above chart represent funds from operations (FFO) per share.

Quarter in Detail

Highwoods leased 1.1 million square feet of second-generation office space during the reported quarter. Same-property cash NOI climbed 3.4% year over year.

During the reported quarter, the company sold assets worth $93 million, which included 28.6% share in three joint-venture buildings. Subsequently, contribution to total revenues from joint ventures reduced to 1.5%.

The company also amended its term loan and unsecured revolving credit facility. The credit facility recast upsized Highwoods’ borrowing capacity by 125 million, extended maturity and lowered the borrowing spread by 10 basis points (bps).

As of Sep 30, 2017, Highwoods had $4.9 million of cash and cash equivalents compared with $49.5 million as of Dec 31, 2016.

2017 Outlook

Highwoods narrowed its 2017 FFO per share guidance range to $3.36-$3.38 from the previous range of $3.33-$3.38. The Zacks Consensus Estimate for 2017 is currently pegged at $3.38.

Our Viewpoint

Improving operating performance reflects brighter prospects for the company, going forward. Highwoods is making diligent efforts to expand its footprint in high-growth markets, and enhance the portfolio quality through prudent asset acquisitions and disposals. Furthermore, the company’s dispositions are anticipated to have miniscule impact on its revenues.

Its focus on high-quality office assets in best business districts (BBDs) bode well. With the recovery in the economy and labor markets, Highwoods will likely experience healthy demand for office space.

Nonetheless, Highwoods faces intense competition from developers, owners and operators of office properties, as well as other commercial real estate, including sublease space available from its tenants. This restricts the company’s ability to attract and retain tenants at relatively higher rents than its competitors.

Highwoods currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The stock has gained 0.5% year to date, underperforming 2.3% growth registered by the industry it belongs to.

We now look forward to the earnings releases of other real estate investment trusts (REITs) like Ventas, Inc. (NYSE:VTR) , Boston Properties, Inc. (NYSE:BXP) and CyrusOne Inc (NASDAQ:CONE) . While Ventas will release earnings on Oct 27, Boston Properties and CyrusOne are slated to report their numbers on Nov 1 and Oct 26, respectively.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

Ventas, Inc. (VTR): Free Stock Analysis Report

Boston Properties, Inc. (BXP): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.