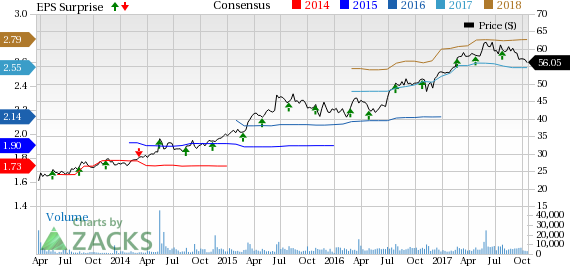

Pinnacle Foods Inc. (NYSE:PF) is slated to report third-quarter 2017 results before the opening bell on Oct 26. The question lingering in investors’ minds is, whether this manufacturer and distributor of branded food products will be able to maintain its positive earnings surprise streak in the to-be-reported quarter. Notably, the company has outpaced the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of 3.1%.

Let’s delve deeper how things are shaping up for this announcement.

What to Expect?

Let’s look at earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company right before the earnings release. The Zacks Consensus Estimate for the quarter under review has been stable at 58 cents in the last 30 days. However, the estimate reflects a year-over-year growth of about 9% from the year-ago quarter.

Further, analysts polled by Zacks expect revenues of $751 million, down more than 1% from the prior-year period.

Markedly, Pinnacle Foods is part of the Consumer Staples sector. As of Oct 20 Earnings Preview, the Consumer Staples sector’s earnings as well as revenues are expected to grow 1.8% each.

Factors Likely to Influence the Quarter

Pinnacle Foods has been gaining from its solid brand portfolio and robust strategic initiatives. The company has been also innovating products to offer variety and maintain market share. Additionally, the company’s expansion via acquisitions drives growth and remains impressive. The notable acquisitions include Boulder Brands and Duncan Hines.

Meanwhile, Pinnacle Foods’ operational excellence program designed to generate annual productivity savings across the supply chain, remains encouraging. Productivity for 2017 is estimated to be at the top or marginally above its cost of products sold range of 3.5–4%. These productivity savings, along with higher pricing have been mitigating the impact of input cost inflation to drive gross margins.

Additionally, in order to enhance gross margin, Pinnacle Foods is pursuing other initiatives including improving its product mix through product innovation and low-margin SKU rationalization, increasing the effectiveness of trade promotional spending, and realizing synergies from acquisitions.

These initiatives are reflected in the company’s share price, which increased 4.8% year to date, as against the industry’s decline of 10.3%.

Further, the Zacks Consensus Estimate for third-quarter revenues of the Frozen, Grocery and Specialty Foods segments are currently pegged at $315 million, $259 million and $84 million, respectively. These estimates show a year-over-year increase of about 2%, 3.8% and 5.8% for each segment, correspondingly.

Also, volume for the Frozen and Grocery segments is likely to increase 0.04% and 0.01%, respectively, in the quarter. However, volumes are expected to decline 0.04% for the Specialty Foods segment.

We note that Pinnacle Foods has been witnessing sluggish net sales and adjusted EBIT for its Specialty segment since four consecutive quarters now, despite solid growth in the Snacks business. Evidently, sales at the segment declined 15.1% in the previous quarter.

Meanwhile, the company has witnessed sluggishness in its Pickle business due to continued competitive environment in the form of pricing and innovation. This, in turn has put pressure on the performance of Vlasic pickles. Though innovation and in-store support for the brand is expected to strengthen trends for the business in the second half of 2017, the turnaround might take some time.

What the Zacks Model Unveils?

Our proven model shows that Pinnacle Foods is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Pinnacle Foods has an Earnings ESP of +2.03%. Also, it carries a Zacks Rank #2, which makes us confident of an earnings beat.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Avon Products, Inc. (NYSE:AVP) has an Earnings ESP of +2.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Colgate-Palmolive Company (NYSE:CL) has an Earnings ESP of +0.50% and a Zacks Rank #2.

The Estee Lauder Companies Inc. (NYSE:EL) has an Earnings ESP of +0.34% and a Zacks Rank #2

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Avon Products, Inc. (AVP): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Pinnacle Foods, Inc. (PF): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Zacks Investment Research