Equity Residential (NYSE:EQR) reported second-quarter 2017 normalized funds from operations (“FFO”) per share of 77 cents, in line with the Zacks Consensus Estimate. The figure was higher than 76 cents reported in the year-ago quarter.

Results reflected enhanced same-store net operating income (NOI) and lease-up NOI. In addition, the company experienced lower corporate overhead. However, the company experienced adverse impact on NOI, primarily stemming from its 2016 huge disposition activity. Also, the company incurred higher interest expense in the quarter.

Per management, there is a solid and steady rental demand in the company’s coastal, gateway markets, helping occupancy, retention and renewal pricing even amid high apartment supply. As such, the company has increased its full year revenue guidance, driven by Seattle, San Francisco and New York City, which are likely to meet the “most optimistic projections for the year”.

Moreover, total revenue during the reported quarter came in at $612.5 million, indicating 2.9% growth from the prior-year period. In addition, the figure surpassed the Zacks Consensus Estimate of $608.4 million.

Quarter in Detail

Same-store revenues (includes 71,354 apartment units) increased 2.1% year over year to $571.4 million and expenses climbed 4.1% year over year to $167.0 million. As a result, same-store NOI advanced 1.3% year over year to $404.3 million.

The company experienced 2.5% growth in average rental rates to $2,669, but occupancy fell 40 basis points from the year-ago quarter to 95.8% for same-store portfolio.

The company exited second-quarter 2017 with cash and cash equivalents of $37.7 million, down from $42.1 million at the end of the prior quarter.

Portfolio Activity

During the quarter, Equity Residential acquired one consolidated apartment property in Seattle (136 apartment units) for around $57.0 million. On the other hand, it sold two consolidated apartment properties (600 apartment units) for a total of approximately $219.1 million. Additionally, the company stabilized its 348-unit 340 Fremont development in San Francisco at a Development Yield of 4.7%.

Outlook

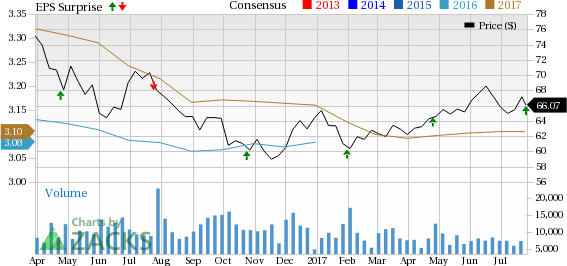

For third-quarter 2017, Equity Residential projects normalized FFO per share in the range of 77–81 cents. The Zacks Consensus Estimate for the same is currently pegged at 78 cents.

The company revised its projections for full-year 2017 and revenue guidance upward. It now estimates normalized FFO per share in the $3.08–$3.14 range compared with the prior guidance of $3.05–$3.15. The Zacks Consensus Estimate of $3.11 lies within this range.

For same-store portfolio, the company revised full-year 2017 physical occupancy to 95.8% from 95.7% and revenue growth in the range of 1.75–2.25% compared with 1.0–2.25% guided previously. Furthermore, expense is projected to increase 3.25–4.0% against the prior range of 3.0–4.0%, while NOI is estimated to grow 0.75–1.75% compared with the previous range of 0.0–2.0%.

Our Viewpoint

Equity Residential is anticipated to benefit from its efforts to reposition its portfolio in high barrier-to-entry/core markets, favorable demographics, lifestyle transformation and creation of new households. The company’s current focus is on the acquisition and development of assets primarily in six core coastal metropolitan areas – Boston, New York, Washington D.C., Southern California, San Francisco and Seattle. Also, there is solid rental demand in its coastal, gateway cities. Nevertheless, amid high apartment supply, new lease rates are likely to remain under pressure.

Equity Residential currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of other residential REITs like Essex Property Trust Inc. (NYSE:ESS) , Apartment Investment and Management Company (NYSE:AIV) and AvalonBay Communities, Inc. (NYSE:AVB) . While Essex Property and Apartment Investment and Management Company are expected to release their results on Jul 27, AvalonBay is likely to report its quarterly numbers on Aug 2.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Apartment Investment and Management Company (AIV): Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Equity Residential (EQR): Free Stock Analysis Report

Essex Property Trust, Inc. (ESS): Free Stock Analysis Report

Original post