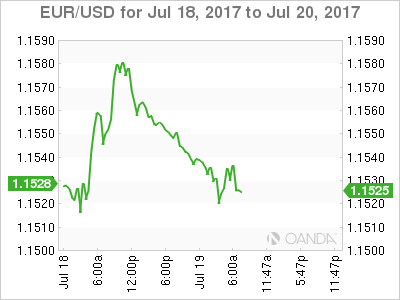

The euro is marginally lower in the Wednesday session. Currently, EUR/USD is trading at 1.1520. On the release front, there are no major eruozone events on the schedule. In the US, construction data will be in the spotlight, with the release of Building Permits and Housing Starts. Both indicators are expected to improve in the June releases.

The euro continues to look sharp against the US dollar. The currency has posted monthly gains since March and is up 0.09% in July. Investors have given the euro a thumbs-up, as the euro-area economy has improved in 2017, buoyed by stronger growth and lower unemployment. On Tuesday, the euro pushed above the 1.15 line, its highest level since May 2016. The euro took advantage of increased political risk in the US, as President Trump’s health care act appears to have floundered in the Senate.

The Trump administration hasn’t had much success in its dealings with Congress, but this week has been particularly difficult. Trump’s proposed health care bill which replaces much of Obamacare, has stalled in the Senate, before lawmakers even voted on the bill. With some conservative Republicans against the bill, it’s questionable if the Republicans can craft a new proposal which could be passed before Congress takes a recess in August. Trump had promised to pass a health care before the summer break, so his credibility will take another hit if he’s unable to do so.

With this latest defeat, there is growing skepticism as to whether Trump will be able to convince Congress to pass other key parts of his agenda, tax reform and fiscal spending. The Republicans also have egg on their faces, as they have been unable to pass any significant legislation since Trump took over, despite having control of both houses of Congress and the White House. This paralysis on Capitol Hill has deepened investor pessimism about the Trump administration and has hurt the US dollar.

Investors are keeping a close eye on the ECB, which holds its monthly policy meeting on Thursday. The bank is not expected to announce any tapering of its asset-purchase program (QE), nor change the end date of the scheme, which is December. The cautious ECB was stunned last month when comments by ECB President Mario Draghi about tweaking QE triggered a sharp rally by the euro. If the eurozone economy continues to show strong numbers, we could see the ECB make some adjustments in its September meeting.

In December 2016, the bank tapered QE while extending the scheme until December, and this type of scenario could be adopted once again. Analysts will be combing through the July statement, as well as Draghi’s press conference, looking for any nuances to tweaks which could hint at substantive changes to come in September.

EUR/USD Fundamentals

Wednesday (July 19)

- Tentative – German 30-y Bond Auction

- 8:30 US Building Permits. Estimate 1.20M

- 8:30 US Housing Starts. Estimate 1.16M

- 10:30 US Crude Oil Inventories. Estimate -3.6M

Thursday (July 20)

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Unemployment Claims. Actual 245K

- 8:30 US Philly Fed Manufacturing Index. Estimate 23.4K

*All release times are EDT

*Key events are in bold

EUR/USD for Wednesday, July 19, 2017

EUR/USD Wednesday, July 19 at 5:35 EDT

Open: 1.1554 High: 1.1557 Low: 1.1515 Close: 1.1536

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1366 | 1.1465 | 1.1534 | 1.1616 | 1.1712 | 1.1866 |

EUR/USD ticked lower in the Asian session and continues to lose ground in European trade

- 1.1534 is providing weak support. This line could break in the Wednesday session

- 1.1616 is the next resistance line

Further levels in both directions:

- Below: 1.1534, 1.1465, 1.1366 and 1.1242

- Above: 1.1616, 1.1712 and 1.1866

- Current range: 1.1534 to 1.1616

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged this week. Currently, short positions have a majority (68%), indicative of EUR/USD continuing to drop lower.