Yesterday the pair USD/CAD slightly grew moving away from the strong support level of 1.3200. The quotes of CAD reacted to the fall of oil prices. The downward trend in the pair was so strong that even the reduction on the price of hydrocarbons failed to push CAD down against USD.

Oil prices may break the strong support level if the volume of reserves is big. The report of the Energy Information Administration of the US Department of Energy is due today. If the volume of oil reserves is above the outlooks of the experts, one may expect oil prices to fall further and the quotes of USD/CAD to grow.

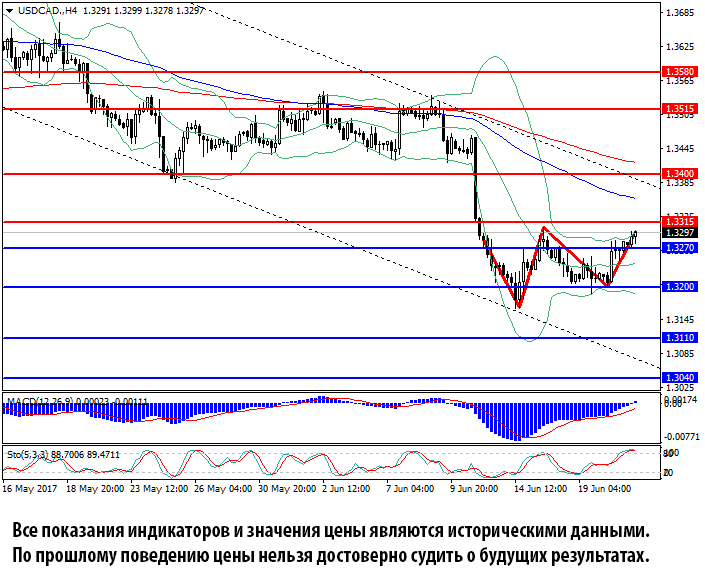

On the H4 chart the pair is consolidating above the level of 1.3270. Indicators show that buy positions have priority. MACD volumes are above the signal line. Stochastic is in the oversold zone with its lines are directed sidewards. The chart shows the "Double bottom" reverse model that will be confirmed if the level of 1.3315 is broken through.

Support levels: 1.3270, 1.3200, 1.3110.

Resistance levels: 1.3315, 1.3400, 1.3515.