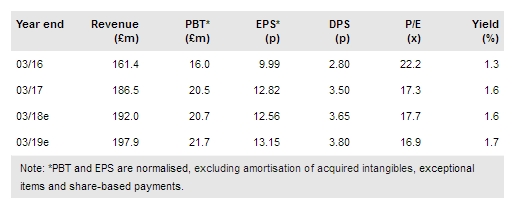

As already announced, record FY17 profits have exceeded management expectations and growth was delivered with a strong cash performance and a sharp rise in the dividend. We have increased our EPS estimates marginally for 2018 with restrained growth expectations. As Trifast (LON:TRFT) continues to deliver on its strategy, the 10% rating discount to peers should moderate.

Strong trading performance

Although previous trading updates had indicated that FY17 had been extremely positive, the company has announced results that are still slightly ahead of our expectations. Underlying PBT rose by 28.1% to £20.5m, with £2.1m of the increase from FY16 generated organically and £2.4m arising from positive FX tailwinds. The result compares to our £16.9m forecast of a year ago, when market conditions appeared much less favourable. The subsequent improvement in demand has occurred across all regions, with a gross margin of 31.1% exceeding 30% for the first time.

Strong cash conversion drove net debt down to just £6.4m at the year end from £16.0m, or £7.6m when normalised for a one-off £1.2m share option-related tax payment that straddled the year end and flowed out in April. The FY17 dividend increase of 25% to 3.5p per share also exceeds expectations, but is still covered 3.7x by adjusted EPS.

To read the entire report please click on the pdf file below: