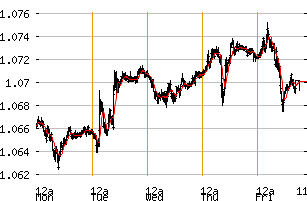

The U.S. dollar climbed to a five-week high against the euro and a basket of other major currencies on Friday, as better-than-expected economic data relieved investors’ worries about a further slowdown in the US economy Friday's data showed that the US labor sector shed 51,000 jobs in July, lower than market expectations, which called for a decline of as many as 75,000. Adding to the dollar’s strength was a fresh easing in oil prices, which has fallen by roughly 20% from its mid-July highs, and further hawkish rhetoric from FOMC members Plosser and Fischer, who are both in favor of hiking interest rates.

Looking forward today, traders will closely eye European PPI readings (09:00 GMT), followed by US Personal Consumption Expenditure at 12:30. Later in the New York session Durable Goods, New Orders and Factory Orders will all hit the wires at 14:00 GMT.

Euro

The EUR/USD opened in Asia around $1.5565 and drifted between $1.5562 and $1.5580 throughout the early session. The pair acquired a bullish direction later on, trading up to $1.5595 before resistance at $1.5600 prevented a move higher. The EUR/USD then drifted back to $1.5575 -$1.5590 where it settled for the remainder of the session.

| Support: | 1.5470, | 1.5400, | 1.5350 | |

| Resistance: | 1.5580, | 1.5600, | 1.5650 |

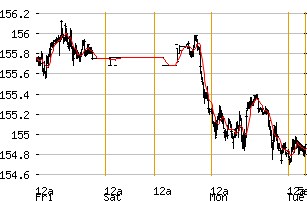

Japanese Yen

USD/JPY still appears to be trading in a ¥107.45 - ¥107.80 range on the hourly chart. After opening in Asian at around ¥107.63, the pair traded to as high as ¥107.74 before correcting lower. Resistance still remains heavy at around ¥108.00.

| Support: | 107.80, | 107.00, | 106.50 | |

| Resistance: | 108.50, | 109.00, | 109.50 |

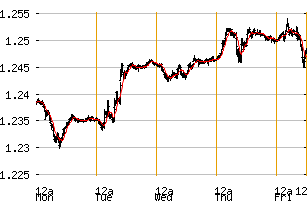

British Pound

The GBP/USD opened in Asia around $1.9750 after selling off on Friday due to weak UK PMI data, and a considerably stronger USD. The GBP/USD traded up to$1.9760 early on, before easing to $1.9732, then rebounding to $1.9750 - $1.9760 where it remained for the rest of the very quiet session.

| Support: | 1.9500, | 1.9450, | 1.9400 | |

| Resistance: | 1.9600, | 1.9650, | 1.970 |