Americans love Thursday holidays in the summer as much of the country will stretch that into a four-day weekend, but that might not be the case for many hedge funds and money managers. Friday’s economic data releases could be a game changer for financial models and could derail weekend plans for many.

A lot of U.S. economic data is wavering, as most key indicators are falling below trend, but the recent standouts have been labor and wage data. If the pillars of the economy begin to show some signs of weakness, this will disrupt the U.S. consumer and support calls for the Fed to cut in July and signal an additional one is on the way.

Today’s data is highlighting the growing of downside risks to the economy. If labor weakens and wages start to fall, markets will ramp up bets the Fed will need more aggressive accommodations to deliver a soft landing.

ADP (NASDAQ:ADP) recently has shown a negative June bias and most economists are still pricing in gain for the headline nonfarm payroll print between 150,000 and 205,000 jobs created in June. Jobless claims however have not yet really picked up, suggesting the economy is not completely falling off a cliff and that the other soft labor data points are showing only a slowdown.

The final U.S. services PMI reading for June was revised higher, bucking the trend we have seen with manufacturing readings, but still hovering not too far from contraction territory.

If the U.S. consumer remains strong, there is no reason why we should not still see economic growth around 2.5% this year.

If NFP comes in as expected around 162,000 jobs, markets should still expect the Fed to deliver a 25-basis point cut at the end of the month. A surprise beat over 225,000 jobs, might see the odds of the July cut ease a bit to 80%.

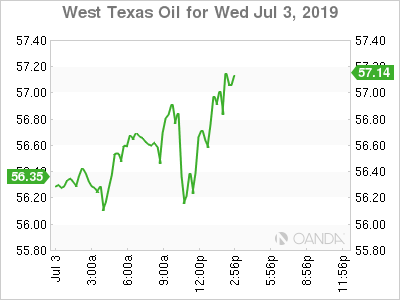

Oil

The oil market was looking for a much bigger draw, but Wednesday’s EIA report only showed stockpiles fell 1.09 million barrels, much less than analysts’ consensus of 2.8 million barrels and the prior drop of 12.8 million barrels. The U.S. oil market remains oversupplied, but today’s report shows that U.S. oil demand still remains strong. The U.S. will eventually become a constant net exporter of oil, but today’s report showed they had a net import of 2 million barrels last week.

Crude is still processing the OPEC + meeting, which delivered a nine-month extension on production cuts, highlighting that the oil-producing countries are concerned about the slowdown with oil demand for the remainder of the year.

Oil prices should be rangebound for the remainder of the summer as OPEC’s effort will do little to ignite a bullish momentum as demand is expected to slow to the slowest pace since 2011. The EIA report was overall bearish, but following the plummet earlier in the week, West Texas Intermediate crude seems to have found some support around the $56.00 barrel level. Brent crude’s support falls at the $62.00 a barrel level.

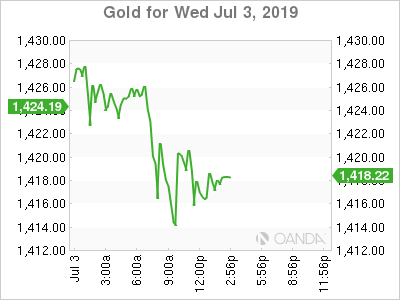

Gold

Gold prices remain firmly supported on dovish bets that the world’s largest banks will continue to deliver more stimulus in the coming months, with the Fed joining the easing party at the end of the month. Bullion bulls are not being derailed by the fresh record highs U.S. markets are posting.

Wednesday’s gold rally was spurred on by expectations that uber-dove Christine Lagarde will replace ECB Chief Draghi in November and that President Trump could see one of his dovish nominations, Christopher Waller, get approved early next year. Trump has seen his past four nominees fail to fill the remaining two seats on the board of governors. Waller, director of research at the St. Louis Fed, also Trump’s informal adviser has been vocal that the central bank needs to lower rates. Judy Shelton is unlikely to get approved as she is a controversial nominee that has spent much of her time away from mainstream economics.

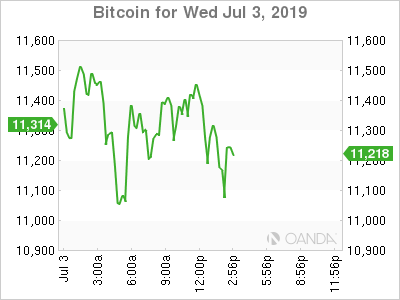

Bitcoin

Bitcoin’s price is being supported by both retail and institutional growing interest. Volatile price swings should not be derailed by the long holiday weekend. If we see the high frequency trading systems and algos take advantage of some thin conditions, we should see $10,000 level provide key support. If Bitcoin can stabilize into early next week, we could see bullish momentum attempt to test the $14,000 resistance level.