- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

An Update On The Silver Bull

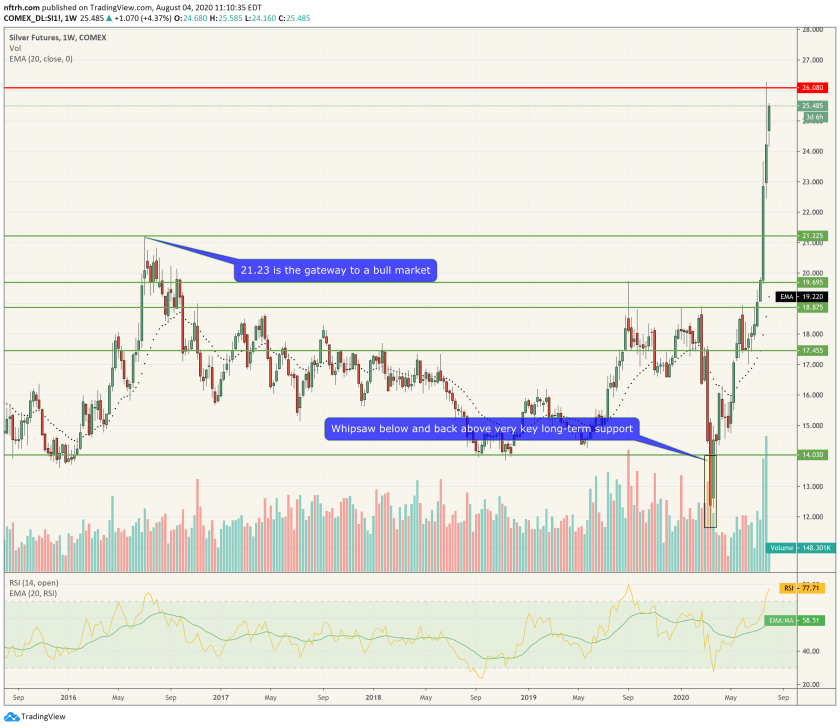

Now, I have not gone raving silver bug on you. The title says “silver bull” because that is what silver is in, a bull market by definition, having taken out the 2016 high of 21.23. We targeted that point as a cyclical bull market gateway. Silver cut through it like a warm knife through butter. A key higher. I don’t apologize for any of the above. It is fact.

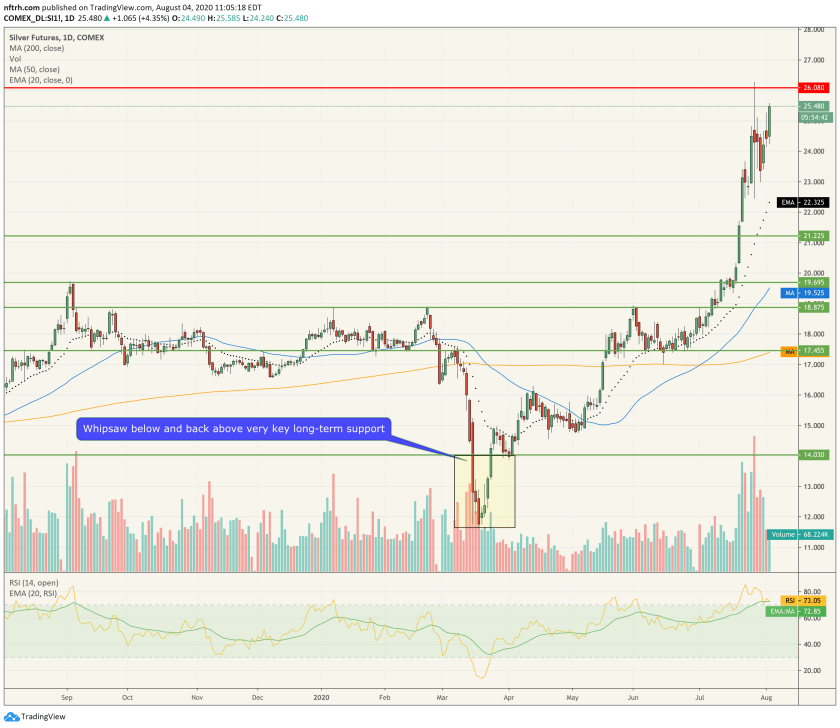

So let’s catch up on gold’s wild little bro as it hangs tough below the NFTRH ultimate cyclical bull target, which has been the 24-26 long-term resistance zone (per the 3rd chart below). Silver made a violent hit and recoiled. But....

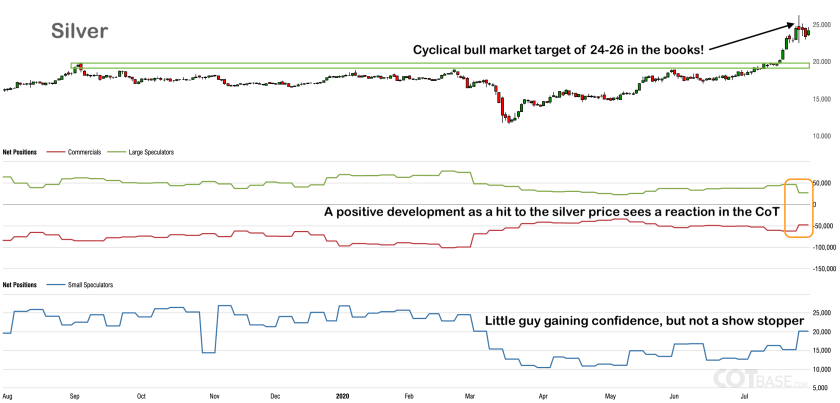

This caused a reaction in the Commitments of Traders data that was positive for the metal. Here is the chart we used in NFTRH 614 (courtesy COTbase, markups mine). The recent negative price reaction drove the CoT to recoil from its situation, which had been seeing over-bullishness by large specs gaining momentum. Now? Not so much. As noted on the chart, sentiment-wise this was a positive development.

While it is likely that silver is on some sort of blow off move right now, the fact that it made the higher high to 2016 calls it a launch, not a final blow off. In other words, the launch phase will blow off and get punished at some point, but it has all the makings of the beginning of an extended bull market (as noted above, it’s already registered our anticipated cyclical bull market resistance zone).

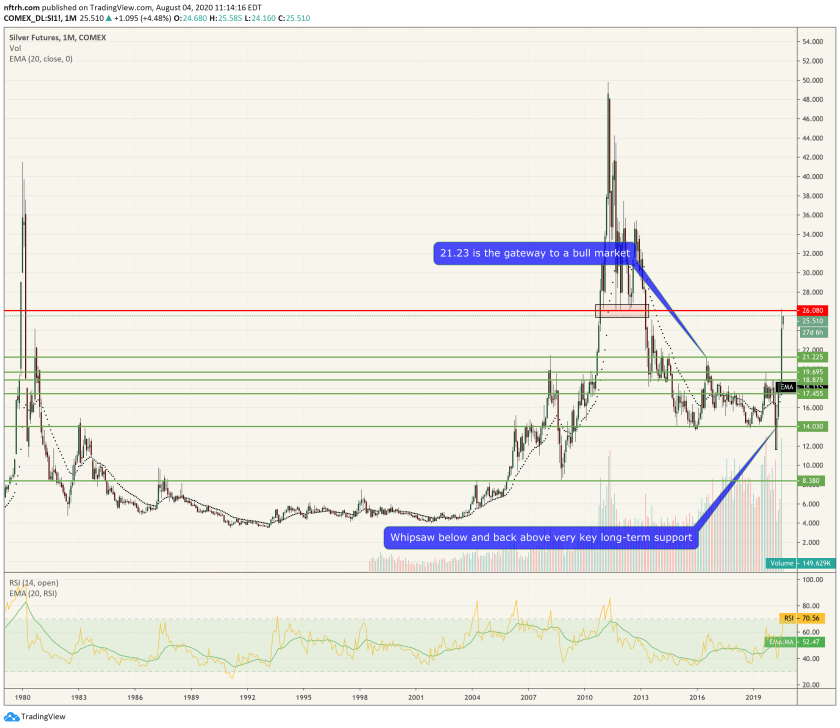

Here’s the monthly view, which is good for perspective. The resistance from 2011-2012 is clear. That does not mean it has to hold as resistance, but it’s there and it should be respected. If silver should take that out however, the sky’s the limit, and the lunatics in the silver bug community could be guiding us to a new high one day above the point where this massive, decades-long Cup’s Handle began to form at $50/oz. For now, however, let’s realize that silver is gaining a lot of attention and the move will be punished. The question is, at what level and from what proximity to resistance (above or below)?

Related Articles

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Oh man, can President Trump’s leadership move markets. President Trump’s deal-making and negotiating skills are changing the hearts and minds of world leaders as he leaves his...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.