- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ambarella (AMBA) Stock Soars On Q4 Earnings & Revenue Beat

Shares of Ambarella Inc. (NASDAQ:AMBA) gained nearly 13.5% last Friday after the company reported better-than-expected fourth-quarter fiscal 2018 results. In fact, the company beat management’s projections at every point — revenues and margins.

However, on a year-over-year basis, its top- and bottom-line results registered declines mainly due to a substantial plunge in chip sales to GoPro Inc. (NASDAQ:GPRO) , along with the prevalent softness in the drone market. Earnings were also adversely affected by elevated operating expenses.

Let’s discuss the quarterly results in detail.

Quarter in Detail

The company’s fiscal fourth-quarter revenues slipped 19.4% year over year to $70.6 million, mainly due to the decline in drone and GoPro sports-camera revenues, partially offset by strong performances in the IP security, auto and non-GoPro wearable markets.

However, quarterly revenues surpassed the Zacks Consensus Estimate of $70 million and came above management’s guided range of $68-$72 million. Moreover, excluding sales to GoPro, revenues remained flat year over year at $57.3 million. Sales to GoPro significantly declined year over year from $30.2 million to $13.3 million. During the fiscal fourth quarter, GoPro’s contribution to total revenues was down to 18.8% from 32.4% in the year-ago quarter.

Apart from GoPro, WT Microelectronics and Chicony were the two companies which have contributed more than 10% to Ambarella’s fiscal fourth-quarter total revenues. WT Microelectronics’ contribution totaled 49.6%, while Chicony contributed 10.3%.

On a non-GAAP basis, the company reported gross margin of 64.7%, which came in 250 basis points (bps) lower than the year-ago quarter. However, the figure expanded 70 bps from the previous-quarter tally, mainly driven by better IP security product mix, and partially offset by softness in drone and sports-camera revenues. Also, the fiscal fourth-quarter non-GAAP gross margin was higher than management’s earlier guidance of 62-63.5%.

Non-GAAP operating expenses came in at $29.5 million, up from $25.4 million incurred in the year-ago quarter and $27.2 million reported in third-quarter fiscal 2018. Operating expenses flared up primarily due to escalating chip-development costs, primarily toward the development of 10-nanometer CV chips. However, non-GAAP operating expenses remained within the company’s previously guided range of $28.5-$30 million.

Non-GAAP operating income dipped to $16.2 million from $33.4 million reported in the year-ago quarter. Operating margin contracted to 22.9% from 38.2% reported in the year-ago quarter chiefly due to reduced gross margin and soaring operating expenses.

Non-GAAP net income plunged to $15.8 million from $32 million reported in the year-earlier quarter. On per-share basis, the company’s earnings came in at 45 cents, witnessing a substantial decline from the year-ago quarter’s level of 92 cents. This year-over-year fall stemmed from lower revenues and elevated operating expenses. However, the figure came well ahead of the Zacks Consensus Estimate of 37 cents.

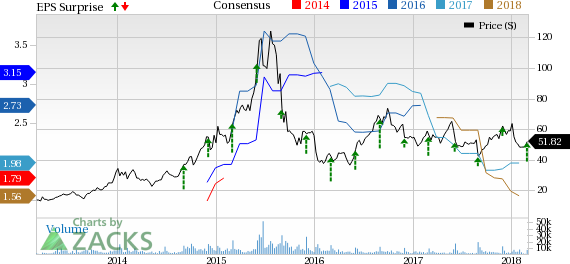

Ambarella, Inc. Price, Consensus and EPS Surprise

Balance Sheet

Ambarella ended the fiscal fourth quarter with cash and cash equivalents & marketable securities of $434.6 million, up from $414 million recorded in the previous quarter.

During the reported quarter, the company bought back 66,747 shares, for a total cash consideration of $3.3 million. Additionally, in February 2018, the company bought 142,344 shares at an average price of $48.05. Since the inception of its share-repurchase programs in June 2016, the company has bought back a total of 1,642,228 shares for a total consideration of $81.8 million. Ambarella has approximately $24.9 million remaining under the $50-million repurchase program, which commenced on Jul 1, 2017.

Guidance

For first-quarter fiscal 2019, revenues are expected to be between $54.5 million and $57.5 million (mid-point $56 million), down 10.3-15% from the year-earlier quarter. The guidance at the mid-point is slightly lower than the Zacks Consensus Estimate of $59.2 million.

Non-GoPro revenues in the fiscal first quarter are likely to drop 12% year over year.

The company predicts that the considerable decline in revenues from the drone market will adversely impact the current quarter’s top-line performance. Additionally, it believes shortage of memory chips will thwart the company’s revenues in the fiscal first quarter. However, Ambarella anticipates strong year-over-year revenue growth in IP security (both professional and consumer) and automotive market.

Non-GAAP gross margin is expected to lie between 60% and 62%, as compared with 64.3% recorded in the year-ago quarter. The contraction will be due to increase in China security revenues and decline in drone revenues.

Non-GAAP operating expenses are estimated between $30 million and $32 million, up sequentially due to increase in “chip tape out fees and engineering head count.”

The company did not provide any outlook for fiscal 2019.

Currently, Ambarella carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader tech space are Intel (NASDAQ:INTC) and Texas Instruments Incorporated (NASDAQ:TXN) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term expected EPS growth rates for Intel and Texas Instruments are 8.4% and 9.6%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ambarella, Inc. (AMBA): Free Stock Analysis Report

GoPro, Inc. (GPRO): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.