- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Altra Industrial To Buy Four Fortive A&S Assets By 2018-End

Altra Industrial Motion Corporation (NASDAQ:AIMC) announced yesterday that it has agreed to combine its operations with four companies of Automation and Specialty business of Fortive Corporation (NYSE:FTV) . The transaction — structured to be tax-free for the shareholders of the two companies — is roughly valued at $3 billion.

Fortive Corporation’s Automation and Specialty (Fortive A&S) is a business platform for the company’s Industrial Technologies segment. Fortive A&S — with brands like Kollmorgen, Dynapar, Thomson, Portescap, Hengstler and Jacobs Vehicle Systems — engages in supplying equipments for the use in robotics, medical devices, industrial automation and precision control end-markets.

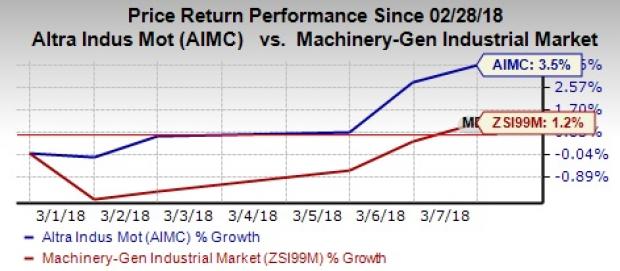

Month to date, the shares of Altra Industrial Motion have yielded 3.5% return, outperforming 1.2% gain recorded by the industry.

Details of the Business Combination Deal

As noted, Altra Industrial will be buying Kollmorgyen, Thomson, Portescap and Jacobs Vehicle Systems businesses of Fortive A&S. These assets generated combined revenues of roughly $907 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $220 million in 2017.

Transaction value of $3 billion will comprise $1.4 billion in cash payment and Fortive’s debt reduction as well as the issuance of 35 million of Altra Industrial’s shares worth $1.6 billion to Fortive shareholders. The company intends to fund the transaction through debt and cash in hand. Its net debts are estimated to be roughly $1.7 billion after the transaction closes. Repaying debts will be a priority for the company.

The company will directly buy certain assets of Fortive while the other part of the transaction will be executed as a Reverse Morris Trust, under which shares of a new Fortive subsidiary — formed especially with the Fortive A&S assets — will be distributed to Fortive’s shareholders. This new Fortive subsidiary will then be merged with Altra Industrial’s subsidiary in lieu of 35 million shares.

Pending regulatory approvals, fulfillment of closing conditions and receipt of shareholders’ approval of Altra Industrial, this transaction is likely to be completed by 2018-end.

Benefits From the Business Combination

Headquartered in Braintree, MA, the combined company will retain Altra Industrial’s name and trade on Nasdaq under the same symbol. It will operate through 52 manufacturing facilities, 25 service centers and an employee base of 9,300. Of the total shareholding in the combined company, roughly 54% will be with the shareholders of Fortive. The rest will be with Altra Industrial’s shareholders.

This global leader in motion control and power transmission will have greater access of end-markets, solid product offering for customers and better technological expertise. Its combined revenues will be $1.8 billion while EBITDA (pre-synergies) will be roughly $350 million and EBITDA margin will be 20%. Earnings per share accretion are anticipated immediately. Free cash flow generation will likely exceed $1 billion in five years after its formation, while annual cost synergies of $46 million and revenue synergies of $6 million from business expansion in new markets will be realized by the fourth year.

Zacks Rank & Key Picks

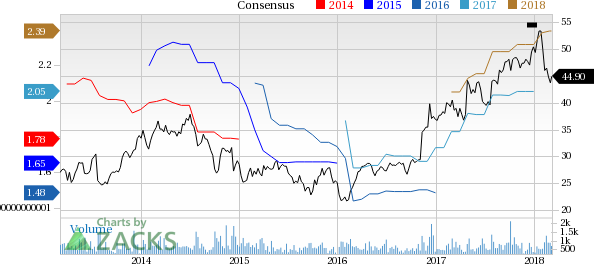

With a market capitalization of nearly $1.3 billion, Altra Industrial currently carries a Zacks Rank #3 (Hold). Earnings estimates for the stock for 2018 have been increased by two brokerage firms in the last 60 days. It is pegged at $2.39, reflecting the growth of 3% from the tally, 60 days ago.

Altra Industrial Motion Corp. Price and Consensus

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.