The current market environment is creating potential opportunities for investors seeking alternative options. These investors can beneit from a discussion comparing active microcap investing and private equity. The topic is a timely one, especially as it pertains to longer-term investment approaches.

Investors look to microcap investments for possible alpha generation tem- pered with risk management, much like other market sectors. However, they approach the sector with a higher tolerance for some of the unique factors inherent in the microcap space: lower liquidity, longer investment horizons, minimal analyst coverage, ‘lumpy’ return streams, and a higher risk/reward ratio than has been typical for larger-cap equity strategies.

The returns and underlying investments of microcap securities provide many similarities to private equity. However, the access, liquidity, trans- parency, low fee structure, and flexibility of the active microcap fund structure may provide a signi?cant advantage for many investors. In a February 12, 2013 article by Bloomberg reporter David Carey, “Buyout- Boom Shakeout Is Seen Leaving One in Four to Starve,” the private equity market’s current difficulties are explained:

Of the roughly 10,000 private-equity funds raised in the decade spanning 2002-2012, at least 200 now qualify as zombie funds. Even more alarming: the amount of assets in zombie funds could reach $500 billion over the next several years, according to the advisory arm Triago, as reported in the Wall Street Journal in June, 2012.

[Private equity] Firms that attracted an unprecedented $702 billion from investors from 2006 to 2008 must replenish their coffers for future deals and avoid a reduction in fee income when the investment periods on those older funds run out, typically after ?ve years. As many as 708 ?rms face such deadlines through 2015, according to London-based researcher Preqin Ltd.

The combination of underperformance and funding needs has set the stage for a purge as investors pull the plug on the weakest ?rms. Only the scope of a shake-out is a matter of debate. “The shakeout will be rather massive,” said Antoine Drean, chairman of Triago SA, a Paris-based ?rm that helps private-equity ?rms raise money. Drean estimates that as many as a quarter of private-equity managers will see their funding pulled by 2018.

Seeking Opportunities Where They Exist

Today, many investors are looking for ways to decrease their allocations to private equity, due in large part to languishing fund performance, uncommitted capital, and long periods of lock ups that prevent them from accessing opportunities present currently in the market. While they may ?nd their investment monies already committed in private equity to be unavailable for deployment, they are actively seeking new investment options that could provide what they feel is the exposure and upside valuation resident in active microcap.

“Liquidity dominates size as a return predictor,” Roger Ibbotson stated in his keynote speech at the ?rst annual Innova- tive Alternative Investment Strategies conference, held in July 2010 in Chicago. “Public equity markets have gradations of liquidity with different liquidity premiums.”

Ibbotson studied 3,500 U.S. stocks by quartile and rebalanced annually from 1972 to 2009. He de?ned liquidity as total annual trading volume divided by total shares outstanding. One takeaway from his presentation at the conference, which focused on alternative investments, was that investors don’t have to go all the way down the liquidity spectrum to private equity to ?nd additional return.1

In his co-authored and widely-regarded white paper, Liquidity as an Investment Style, (Zhiwu Chen, Roger Ibbotson, Wendy Hu) last updated in August 2012, Ibbotson notes, “However, it is true that the liquidity effect is the strongest among micro-cap stocks and then declines from micro to small to mid to large-cap stocks .” The paper goes on to conclude that liquidity may be managed “low in cost” by employing a low portfolio turnover strategy.

Investors are finding that active microcap allows for greater flexibility, transparency and liquidity as well as lower fee structures than private equity investments. What follows is a look at some of the opportunities and challenges present when considering the investment alternatives of private equity and active microca

Private Equity’s Growing Challenge-Liquidity

Long touted as a way for investors to participate in the opportunistic retooling of businesses, private equity has been mired in a protracted slump since 2008. This issue is largely centered on liquidity, or, more accurately, the lack thereof. One of the biggest challenges private equity managers face is when and how to exit the strategies set up in the vintage years of these funds-typically 10-12 years prior.

Valuation issues, lack of buyers, financing challenges, and related financial uncertainties have coalesced into a perfect storm of illiquidity that has given rise to the dreaded ‘zombie’ fund scenario, where managers find themselves unable to execute attractive exits from previously attractive private equity holdings. They remain running funds well beyond their anticipated lifespan, locking away investors’ capital from redeployment and generating fees that arguably offer little value to the investors trapped within the fund. The private equity advisory firm, Triago, reported to PE Manager on April 9 of this year that an estimated $14.5B in capital commitments is expected to reach the end of its investment period in 2013, referring to this situation as a “fuse burning on a dry powder keg.

Northern Trust, in its Spring 2010 Point of View Managing Liquidity in the Private Equity Market elaborated on the is- sue. “Private equity investors accept that the timing of both the funding of their investments, as well as the distributions of any returns, is difficult to forecast and largely out of their control. Yet even the most knowledgeable investors still seek better ways to understand the likely behavior of their holdings of these long-term obligations.“ In the article, Northern Trust’s Vice President of Private Equity, Raj Vora, points out one of the unattractive features surrounding private equity investments: “The timing of these ‘exit strategies’ depends on a range of factors, such as the vagaries of the markets for public offerings and acquisitions.2

Of the roughly 10,000 private-equity funds raised in the decade spanning 2002-2012, at least 200 now qualify as zombie funds. Even more alarming: the amount of assets in zombie funds could reach $500 billion over the next several years, according to the advisory ?rm Triago, as reported in the Wall Street Journal in June, 2012.

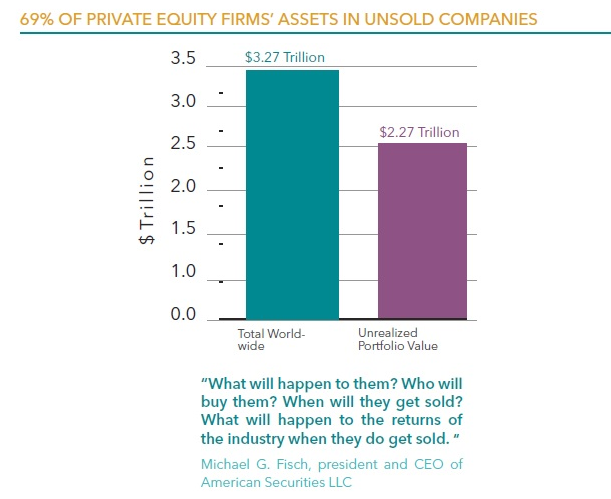

Pensions & Investments provided a recent update on this pressing issue in an April 1, 2013 article, “69% of Private Equity Firms’ Assets in Unsold Companies.” Of the more than $3.27 trillion in total worldwide private equity assets under management as of Sept. 30, $2.27 trillion is “unrealized portfolio value” or unsold portfolio companies, according to data prepared for Pensions & Investments by Preqin.

Active Microcap as a Proxy for Private Equity

Let’s return to the discussion of microcap companies and their potential to deliver value. Both active microcap managers and private equity managers are attracted to microcap companies for many of the same reasons: there are high-potential companies resident in the sector with what they believe is strong cash generation, typically low leverage, established on highly functional business and operational processes, and a niche focus that allows for concentrated strategic growth if the environment provides for it.

Because active microcap and private equity managers both seek these types of company profiles, their respective performance tends to track and therefore has provided a similar return stream to investors. It is important to note, however, a critical distinction between the two: Active microcap managers with the requisite skills have generated these results for investors with greater liquidity and transparency than private equity managers, and often have done so without relying on companies that are highly leveraged.

The correlation comparison for active microcap and private equity is an important factor for investors to consider. While both asset classes historically have exhibited a high positive correlation to each other, they have shown relatively low correlation to the broader equity markets, and active microcap has achieved its results with a lower fee structure than was typical for private equity investments. The table on the following page illustrates this active microcap correlation comparison with private equity returns.

Steven N. Kaplan, author of Reassessing Private Equity (ChicagoBooth.edu), offers a relevant observation on the illiquid nature of private equity investments when considering the relative value of such investment tactics:

One of the controversies surrounding private equity is whether investors are getting a good return on their investment, particularly when compared with investing in the overall stock market. Private equity firms are not required to disclose their funds’ returns and they invest only in companies that are not publicly traded, making it harder to get an accurate picture of their performance. The tremendous success of venture capital funds in the 1990s attracted a huge amount of capital in the early 2000s that subsequently contributed to lower returns. This boom and bust cycle has been a recurring feature of private equity-returns tends to fall with more capital, but go back up again when less money is invested in private equity.

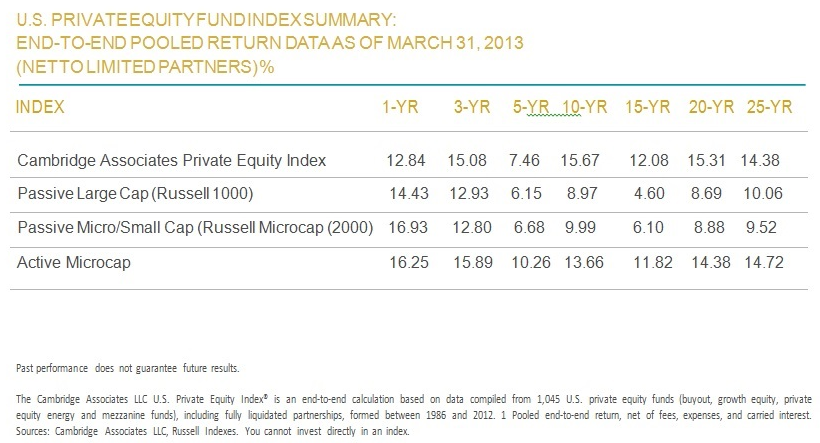

The following table shows a comparison of performance of private investments to public markets, so investors can judge for themselves the decision to take on the risks (e.g., illiquidity) associated with private investments.

References:

1 Financial Advisor, Ibbotson Finds Liquidity Rules, Evan Simonoff, September 2, 2010

2 Raj Vora, Vice President of Private Equity, Northern Trust, Managing Liquidity in the Private Equity Market, Northern Trust’s Point of View, Spring 2010

3 Aquitas Investments: Active Microcap: A Liquid, Transparent Private Equity Alternative, August 2012

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Alternatives: Active Microcap Vs. Private Equity

Published 09/26/2013, 02:18 AM

Updated 07/09/2023, 06:31 AM

Alternatives: Active Microcap Vs. Private Equity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.