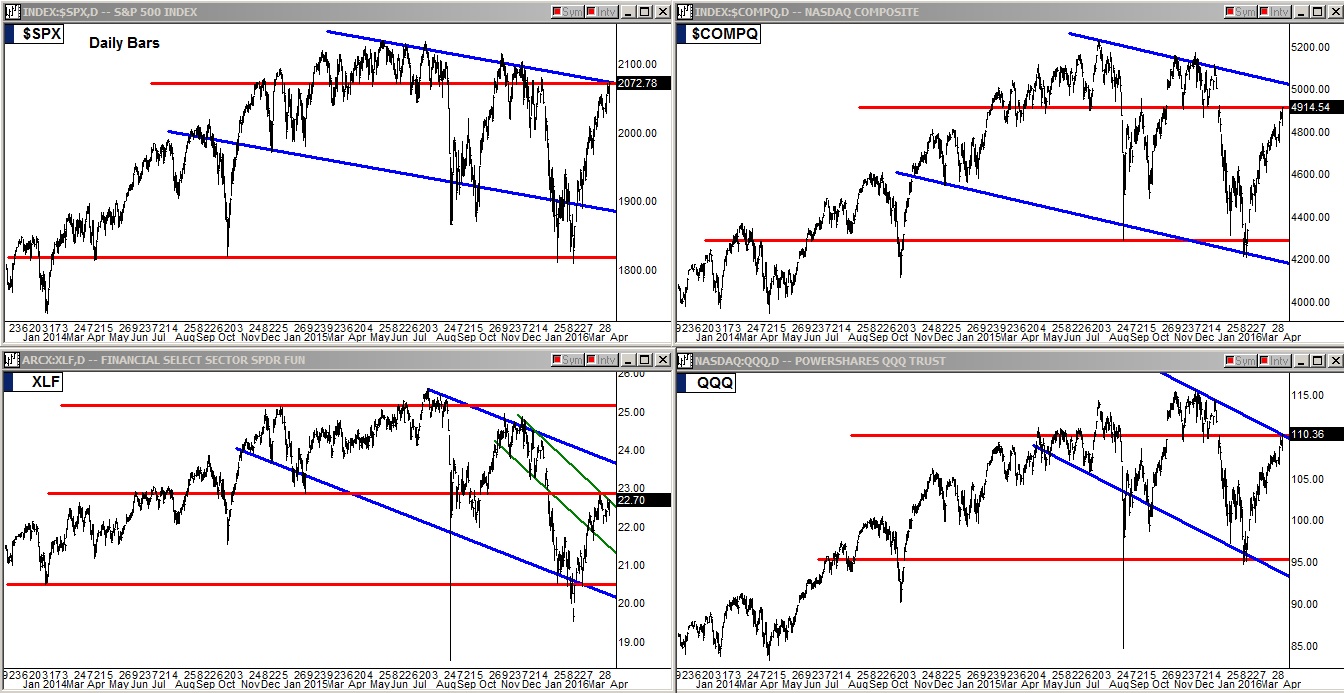

The S&P 500, Nasdaq, PowerShares QQQ Trust Series 1 ETF (NASDAQ:QQQ), and Financial Select Sector SPDR ETF (NYSE:XLF) all four were squeezed right up to major resistance Friday afternoon. The S&P and QQQ are in virtually the same situation as they are both up against their one-year and two-year upper channel lines simultaneously. The Nasdaq is up against one major channel line, but it is a clearly defined and well honored two-year channel line. The XLF was rejected by the center line of its two-year channel recently and is now caught in a steep short-term declining channel, shown with green lines.

Next, taking a look at how Monday is looking I posted the 60-minute bars chart below.

We can see that the S&P closed Friday at the upper line of the new channel being established (shown in blue). Considering the S&P is maxed out in this channel, it suggests that Monday will bring a pullback for the S&P.