- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Alibaba (BABA) Expands In Digital Media Via Yinhekuyu Buyout

Alibaba Group Holding Limited (NYSE:BABA) is looking to expand foothold in the digital media and entertainment industry.

In this regard, the company recently announced that its subsidiary, Alibaba Pictures has acquired a majority stake in Yinhekuyu Media for about $57 million (RMB400 million).

Yinhekuyu Media is a producer of video content in China. Its content includes short videos, films and web TV dramas. In 2016, Alibaba’s video-streaming platform Youku had worked with Yinhekuyu to produce a popular entertainment TV show in China, namely Mars Intelligence Agency.

Alibaba Pictures expects the latest acquisition to further enhance its production team. In addition, the deal is expected to enable greater collaboration with other businesses, which include ticketing and promotion unit Tao Piao Piao and Alifish, its derivative products unit.

We believe Alibaba’s latest deal is in line with its strategic focus on digital entertainment. The latest move should expand the company’s user base and help it fend off competition.

In the past year, Alibaba has lost 1.4% compared with the industry’s decline of 6%.

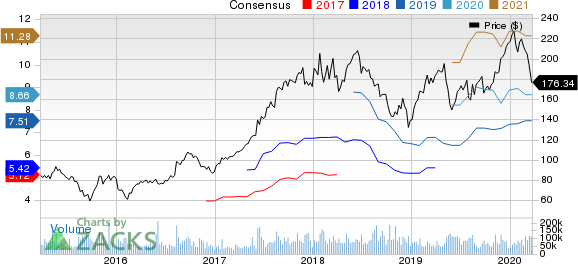

Alibaba Group Holding Limited Price and Consensus

Looking Ahead

The China-based e-commerce giant intends to fortify presence in the digital media and entertainment industry.

Alibaba Pictures, listed in 2016, operates under the Digital Media and Entertainment business. The segment operates businesses through media properties that include UCWeb, YoukuTudou, OTT TV service, Alibaba Music and Alibaba Sports.

In fiscal third-quarter 2020, revenues in Digital Media and Entertainment were RMB7.4 billion (US$1.06 billion), reflecting an increase of 14% on a year-over-year basis. The segment’s top-line growth was driven by consolidation of Alibaba Pictures.

The latest deal is reflective of the China-based Internet giant’s continuous efforts to make a mark in online entertainment, as it seeks to attract more users to its platforms, thereby driving top-line growth.

However, over the past two years, China’s entertainment sector has been facing a lot of issues from new industry regulator, growing content controls, a new tax regime, among others. Moreover, the coronavirus pandemic has resulted in shutdown of production, making the situation all the more worse.

Nevertheless, growing endeavors by Alibaba could help the company battle the situation on the back of new strategies that include partnerships and acquisitions.

Zacks Rank & Other Stocks to Consider

Currently, Alibaba has a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Stamps.com Inc. (NASDAQ:STMP) , eBay Inc. (NASDAQ:EBAY) and Atlassian Corp. (NASDAQ:TEAM) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, Atlassian Corp. and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

eBay Inc. (EBAY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.