- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Air Products Inks Another Oxy-Fuel Contract With Techpack

For the supply of its integrated oxy-fuel combustion solution, Air Products and Chemicals, Inc. (NYSE:APD) inked a deal with Techpack Solutions.

This is the third project of Air Products, wherein it will supply solutions to Techpack to help it convert its furnace from air-fuel to oxy-fuel for enhanced sustainability and competitiveness. Notably, Air Products will supply the oxygen and combustion systems needed by Techpack at its manufacturing complex, when the project comes onstream.

The integrated solution contains Air Products' advanced oxy-fuel combustion system. Notably, the company's oxy-fuel combustion system includes Cleanfire HRi and latest Cleanfire HRx oxy-fuel burners, and an automatic flow control skid. It also includes a PRISM vacuum swing adsorption oxygen generator for supplying reliable and cost-effective on-site oxygen needed to power oxy-fuel burners for melting glass.

With improved functionality and flexibility, the patent-pending Cleanfire HRx oxy-fuel burner allows glass producers to monitor the amount and position of oxygen staging up to 95% of the combustion oxygen. This results in ultra-low emissions of nitrogen oxides (NOx), higher fuel performance, improved production, and better product quality. Notably, the latest model is anticipated to minimize NOx emissions further by 40%.

The oxy-fuel combustion technology of Air Products is proven to offer numerous benefits such as reducing more than 80% of nitrogen oxide emissions, generating 10-35% energy savings and bringing around 25% increase in productivity along with improvement in efficiency and glass quality.

Per management, the company will continue to leverage its vast expertise, advanced technology and deep local understanding to support Korean glass producers to improve their furnace efficiency to minimize environmental footprint and enhance competitiveness.

Air Products’ shares have gained 3.9% in the past year against the industry’s decline of 56.8%.

For fiscal 2020, the company expects adjusted earnings of $9.35-$9.60 per share, which suggests growth of 14-17% from the year-ago reported figure.

It also expects adjusted earnings of $2.10-$2.20 per share for second-quarter fiscal 2020, implying a 9-15% year-over-year rise.

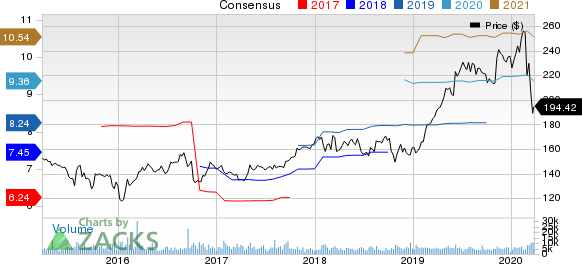

Air Products and Chemicals, Inc. Price and Consensus

Zacks Rank & Stocks to Consider

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Franco-Nevada Corporation (TSX:FNV) , NovaGold Resources Inc. (NYSE:NG) and Barrick Gold Corporation (NYSE:GOLD) .

Franco-Nevada has a projected earnings growth rate of 24.2% for 2020. The company’s shares have rallied 43.8% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently flaunts a Zacks Rank #1. The company’s shares have surged 83.9% in a year.

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 34.5% for 2020. The company’s shares have gained 18.7% in a year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.