- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Air Lease (AL): Strong Industry, Solid Earnings Estimate Revisions

One stock that might be an intriguing choice for investors right now is Air Lease Corporation (NYSE:AL) . This is because this security in the Transportation - Equipment and Leasing space is seeing solid earnings estimate revision activity, and is in great company from a Zacks Industry Rank perspective.

This is important because, often times, a rising tide will lift all boats in an industry, as there can be broad trends taking place in a segment that are boosting securities across the board. This is arguably taking place in the Transportation - Equipment and Leasing space as it currently has a Zacks Industry Rank of 29 out of more than 250 industries, suggesting it is well-positioned from this perspective, especially when compared to other segments out there.

Meanwhile, Air Lease is actually looking pretty good on its own too. The firm has seen solid earnings estimate revision activity over the past month, suggesting analysts are becoming a bit more bullish on the firm’s prospects in both the short and long term.

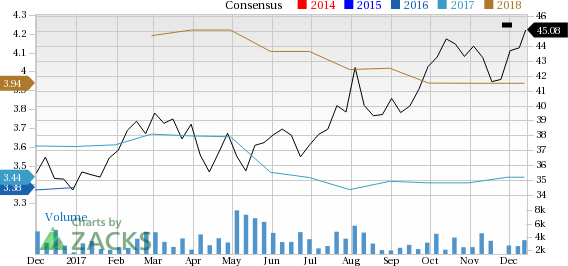

Air Lease Corporation Price and Consensus

In fact, over the past two months, current quarter estimates have risen from 85 cents per share to 88 cents per share, while current year estimates have risen from $3.41 per share to $3.44 per share. The company currently carries a Zacks Rank #3 (Hold), which is also a favorable signal. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

So, if you are looking for a decent pick in a strong industry, consider Air Lease. Not only is its industry currently in the top third, but it is seeing solid estimate revisions as of late, suggesting it could be a very interesting choice for investors seeking a name in this great industry segment.

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Air Lease Corporation (AL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.