- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aduro (ADRO) Q4 Loss Narrower Than Expected, Revenues Miss

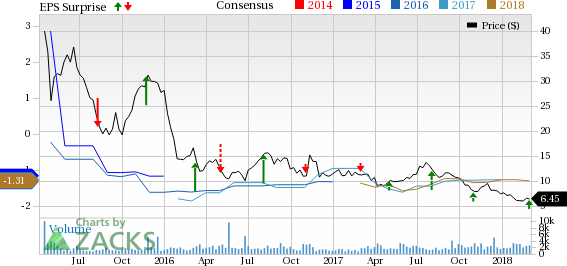

Aduro Biotech, Inc. (NASDAQ:ADRO) reported fourth-quarter 2017 loss of 34 cents per share, narrower than both the Zacks Consensus Estimate of a loss of 36 cents and the year-ago loss of 44 cents.

Quarterly revenues fell 3.1% year over year to $3.8 million, mainly due to a decrease in grant revenues. The top line also missed the Zacks Consensus Estimate of $4 million.

Aduro’s shares have underperformed the industry in a year’s time. The stock has declined 41.4%, comparing unfavorably with the industry’s decrease of 5.3%.

Research and development expenses rose 9.6% in the reported quarter to $22.9 million, mainly due to an increase in costs related to manufacturing of B-select antibodies and higher facility related costs. However, this downside was partially offset by decreased manufacturing costs regarding discontinuation of the company’s pancreatic cancer program.

General and administrative expenses were $8.8 million, up 10% year over year on higher stock-based compensation expense and consulting and professional fees.

2017 Results

While full-year sales tumbled 66.1% year over year to $17.1 million, full-year loss of $1.26 per share was narrower than the year-ago figure of $1.40.

Pipeline Update

Aduro has a broad pipeline of novel immunotherapies being developed for treating a variety of cancers.

The company evaluates its STING pathway activator, ADU-S100, in combination with Novartis AG’s (NYSE:NVS) PD-1 checkpoint inhibitor, PDR001, in a phase Ib trial for treating solid tumors and lymphomas. Additionally, the candidate is being evaluated in a phase I study as a monotherapy on patients with cutaneous accessible metastatic solid tumors or lymphomas. Top-line data from the program is expected soon.

Meanwhile, in December 2017, Aduro announced that it has initiated a phase I/II2 dose escalation study, examining its pipeline candidate, BION-1301, for treatment of adults with relapsed or refractory multiple myeloma.

Zacks Rank

Aduro carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.37 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Ligand’s earnings per share estimates have been revised upward from $3.78 to $4.15 for 2018 in the last 30 days. The company delivered a positive surprise in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has surged 50.4% over a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Novartis AG (NVS): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.