- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lindsay Hits New 52-Week High On Strong Q3 Results & Outlook

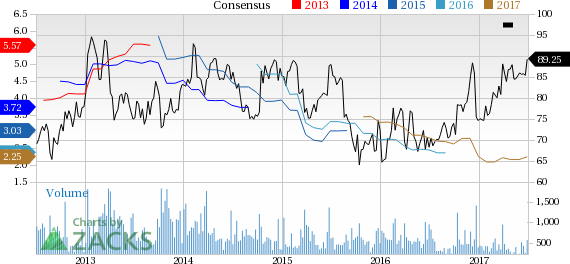

Shares of Lindsay Corporation (NYSE:LNN) scaled a new 52-week high of $92.74 during trading session on Jun 30, following its third-quarter fiscal 2017 results ended May 31, 2017. The company eventually closed the trading session a little lower at $89.25.

This Omaha, NE-based leading designer and manufacturer of self-propelled center pivot and lateral move irrigation systems, has a market cap of roughly $975 million. The average volume of shares traded in the last three months is around 71.57K.

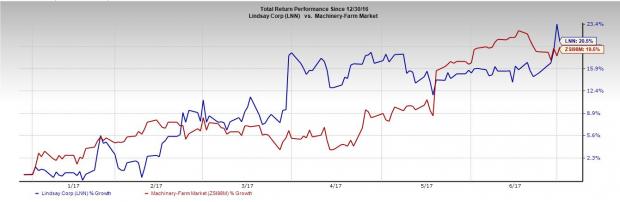

Year to date, Lindsay’s stock has outperformed the Zacks categorized Machinery-Farm industry. While the stock has gained 20.5%, the Zacks sub-industry recorded 19.5% growth.

Positive earnings estimate revisions for 2017 and 2018 as well as earnings growth expectation of 13.50% for the next five years indicate the stock’s potential for further price appreciation.

Growth Drivers

Lindsay reported third-quarter fiscal 2017 (ended May 31, 2017) earnings of $1.02 per share compared with 90 cents per share recorded in the prior-year quarter. Earnings surpassed the Zacks Consensus Estimate of 92 cents, generating a positive earnings surprise of around 10.9%. The company delivered an average positive earnings surprise of 3.29% in the trailing four quarters.

The company’s backlog as of May 31, 2017, was $70.1 million compared with $61.2 million as of May 31, 2016.

Further, it expects that stabilization in the U.S. irrigation equipment market, a consistent recovery in Brazil and increased project activity in developing international markets will drive growth. The company also stated that its irrigation operating margin performance in the U.S. will likely benefit from the strength and growth of technology products. Further, growers’ sentiment in the U.S. has been displaying signs of improvement.

Moreover, Lindsay is poised to gain from improving activity levels in the international irrigation and infrastructure markets. Additionally, population growth, increased food production, efficient water use and infrastructure upgrades are likely to propel long-term growth.

Lindsay Corporation Price and Consensus

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Lindsay Corporation (LNN): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.