- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Adobe (ADBE) Beats On Q4 Earnings, Issues Guidance For 2018

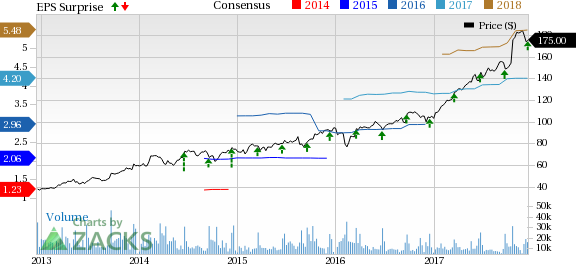

Adobe Systems Inc. (NASDAQ:ADBE) reported adjusted fourth-quarter fiscal 2017 earnings of $1.26 per share, surpassing the Zacks Consensus Estimate of $1.15 per share.

The outperformance was backed by the company’s strong execution and record revenues in Adobe Creative Cloud, Document Cloud and Experience Cloud.

Adobe has been working hard in order to make its presence felt in cloud-related software areas such as documents and marketing. Adobe Experience Manager, which enables brands to offer a personalized experience, is also witnessing robust growth.

Following the earnings results, its share price was up 0.91% to $176.6 in after-hours trading. Also, the company’s shares have charted a solid trajectory, increasing 73.2% year to date and outperforming the industry’s rally of 36.7%.

We remain optimistic about Adobe’s market position, compelling product lines, continued innovation, strong cash flow generation and solid balance sheet. Also, the company’s expansion in growing markets such as artificial intelligence and machine-learning framework is a big positive.

Revenues

Adobe’s revenues of $2.01 billion increased 9% sequentially and 24.8% year over year. Reported revenues surpassed both management’s guidance and the Zacks Consensus Estimate of $1.95 billion.

Subscription comprised 85% of Adobe’s total fiscal fourth-quarter revenues, up 34.4% from the year-ago period. Products declined 13.1% year over year and contributed 10% to revenues, while Services & Support declined 5.2% and brought in the rest.

Revenues by Segment

Revenues from Digital Media Solutions surged 29% year over year to $1.39 billion. Total Digital Media ARR (Annualized Recurring Revenue) grew to $5.23 billion at the end of the fiscal fourth quarter, reflecting an increase of $359 million and indicating strong growth in the Creative Cloud and Document Cloud business lines.

The two major revenue contributors within the segment were Creative Cloud (CC) and Document Cloud (DC).

Creative revenues touched $1.16 billion in the quarter, reflecting an increase of 30% year over year. Also, Creative ARR increased by $3.15 billion in the fourth quarter. Growth was driven by net-new subscriptions, improving ARPU across key offerings, the attachment of services with Team and Enterprise offerings and continued momentum with Adobe Stock.

DC revenues were $235 million, increasing 23% year over year. Also, DC ARR was $600 million at the end of the fiscal fourth quarter. The performance was driven by continued strength in Acrobat subscription adoption and strong year-end Acrobat perpetual product licensing through the channel. Also, Adobe Sign achieved strong results and aided to Document Cloud ARR growth.

Notably, Acrobat units across Creative Cloud and Adobe Document Cloud combined witnessed robust growth, driven by a record number of new subscriptions in the quarter.

Within the Digital Marketing segment, Adobe Experience Cloud revenues were up 18% year over year to $550 million. Multi-solution selling in the company’s top accounts and strong bookings of the Adobe/Microsoft solutions drove the sequential growth. Adobe Experience Cloud includes Adobe Marketing Cloud, Adobe Analytics Cloud and Adobe Advertising Cloud. Mobile remains a key component for this business.

The company has been making great progress in all the three spaces. It has announced new capabilities in Adobe Target to further enhance customer recommendations and targeting, optimize experiences and automate the delivery of personalized offers.

Margins

Gross margin was 86.5%, up 80 basis points (bps) sequentially and flat year over year. Gross margin is typical of a software company and variations are generally related to the mix of revenues between categories.

Adobe incurred adjusted operating expenses of $1.1 billion, reflecting an increase of 18.5% year over year. As a percentage of sales, research & development expenses increased, while general & administrative and sales & marketing expenses decreased from the year-ago quarter. As a result, adjusted operating margin was 40.2%, reflecting an increase of 350 basis points (bps) year over year.

Net Income

On a GAAP basis, Adobe recorded net income of $501.5 million ($1 per share) compared with $399.6 million (80 cents per share) in the year-ago quarter.

On a pro forma basis, Adobe generated net income of $629.9 million compared with $452.6 in the year-ago quarter.

Balance Sheet

Adobe ended the fiscal fourth quarter with a cash and investments balance of $5.82 billion compared with $5.37 billion in the previous quarter. Trade receivables were $1.2 billion, increasing from $1 billion in the prior quarter. Deferred revenues were $2.4 billion compared with $2.1 billion in the prior quarter.

In the reported quarter, cash generated from operations was $833 million and capital expenditure was $37.7 million. Additionally, the company repurchased approximately 1.9 million shares for $297 million.

Guidance

For the first quarter of fiscal 2018, management expects revenues of $2.40 billion. Analysts polled by Zacks expect revenues of $2.04 billion, below the guided figure.

Based on a share count of 500 million, management expects GAAP earnings per share of $1.15 and non-GAAP earnings of $1.27 per share. The Zacks Consensus Estimate is pegged at $1.24 for the upcoming quarter.

For the fiscal year 2018, management expects total revenues of approximately 8.725 billion. The Zacks Consensus Estimate is pegged at $8.69 billion. Further the company expects digital media segment revenue growth of approximately 23%, Adobe Experience Cloud subscription revenue growth of approximately 20% and Adobe experience cloud total revenue growth of approximately 15%.

GAAP earnings per share are expected approximately of $4.40 and non-GAAP earnings per share of approximately $5.50.The Zacks Consensus Estimate is pegged at $5.47 per share for fiscal 2018.

Zacks Rank & Stocks to Consider

Currently, Adobe carries a Zacks Rank #2 (Buy). A few other top-ranked stocks in the broader technology sector are Groupon Inc. (NASDAQ:GRPN) , PetMed Express, Inc. (NASDAQ:PETS) and SMART Global Holdings, Inc. (NASDAQ:SGH) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Groupon, PetMed Express and SMART Global is projected at 10%, 10% and 15%, respectively.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.