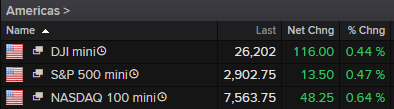

The stock market run looks set to continue on Tuesday, with Europe trading comfortably in positive territory and U.S. futures signalling a similar session on Wall Street.

Safe to say, the changing expectations for interest rates is the primary reason for such a strong rebound in the markets that didn’t look particularly likely at the start of last week. Once again, it’s central banks that are left to fill the economic void, easing investor fears over trade wars and a global slowdown.

Of course, should the G20 meeting between Trump and Xi at the end of the month reach a successful conclusion, that balance may shift while also likely being favourable for stock markets. It may not entirely remove concerns about the outlook for the global economy but this is widely regarded as being the greatest risk.

There may well be some hangover from a large number of months of disruption and uncertainty which acts as a continued drag on the outlook. Not to mention the fact that Trump is unlikely to end the tariff offensive with China, with the EU and Japan being next in the firing line. We also have other issues to contend with including Brexit and a slowdown in Europe.