- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What's In Store For Ally Financial (ALLY) In Q3 Earnings?

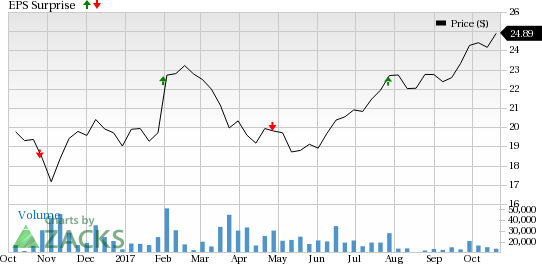

Ally Financial Inc. (NYSE:ALLY) is slated to announce third-quarter 2017 results on Oct 25 before the market opens. Its revenues and earnings are projected to grow year over year.

Last quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results benefitted from an increase in revenues, partially offset by higher expenses. Higher provision for loan losses remained a headwind.

However, the company does not have an impressive earnings surprise history. Its earnings managed to surpass the Zacks Consensus Estimate in only two of the trailing four quarters, the average beat being 4.3%.

Moreover, activities of the company during the third quarter were inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for earnings decreased 3.4% over the last 30 days. Nevertheless, the figure represents growth of nearly 2% on a year-over-year basis.

Also, the Zacks Consensus Estimate for sales is $1.46 billion for the to-be-reported quarter, which is expected to witness a rise of 5.3% year over year.

Notably, the company’s price performance has been quite encouraging. Its shares have gained 27.7% in a year’s time, outperforming the industry’s rally of 20.5%.

Will the rally in stock price continue post Q3 earnings release?

Let’s take a look at how things have shaped up for this announcement.

Earnings Whispers

According to our quantitative model, chances of Ally Financial beating the Zacks Consensus Estimate in the third quarter are low. This is because it does not have the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Ally Financial has an Earnings ESP of -2.00%.

Zacks Rank: Ally Financial currently carries a Zacks Rank #4 (Sell).

Factors to Influence Q3 Results

Lower Used Vehicle Prices to Hurt Results: With management’s expectations of a decline in used vehicle prices, Ally Financial’s earnings are likely to be adversely impacted to quite an extent as it primarily deals in auto loans.

Further, lease revenues are projected to decline during the quarter owing to a smaller lease portfolio as well as lower used vehicle value.

Higher Rates to Support Net Interest Income (NII): Given the higher interest rates and Ally Financial’s efforts to diversify into mortgage business, NII is expected to increase in the third quarter.

Operating Expenses to Rise: Ally Financial has been making efforts to grow inorganically, introduce new products and diversify operations. Given these initiatives, the company is likely to witness an increase in operating expenses. Management expects expenses to be $760 million in the quarter.

Stocks to Consider

Here are a few stocks you may want to consider, as according to our model, these have the right combination of elements to post an earnings beat this quarter.

TD Ameritrade Holding Corporation (NASDAQ:AMTD) is slated to report results on Oct 24. It has an earnings ESP of +0.82% and a Zacks Rank #2 (Buy).

Legg Mason, Inc. (NYSE:LM) has an Earnings ESP of +0.97% and carries a Zacks Rank of 3. It is scheduled to report results on Oct 25.

Lazard Ltd. (NYSE:LAZ) is slated to report results on Oct 26. It has an earnings ESP of +1.39% and carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Ally Financial Inc. (ALLY): Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD): Free Stock Analysis Report

Legg Mason, Inc. (LM): Free Stock Analysis Report

Lazard Ltd. (LAZ): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.