- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ABB To Grow On Robust Demand, Buyouts & Cost Restructuring

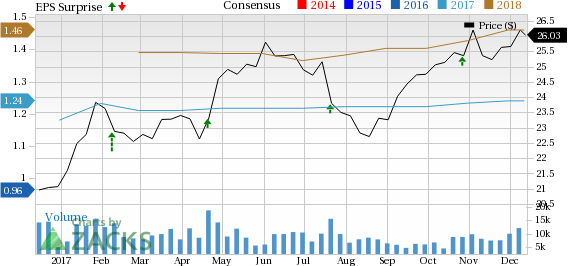

Investors seem to be optimistic about ABB Ltd’s (NYSE:ABB) recent earnings beat streak, as the company’s earnings have trumped estimates in each of the four trailing quarters. We expect this Zacks Rank #2 (Buy) company to continue to accelerate its momentum, driven by contribution from its accretive acquisitions, successful restructuring efforts and cost saving initiatives.

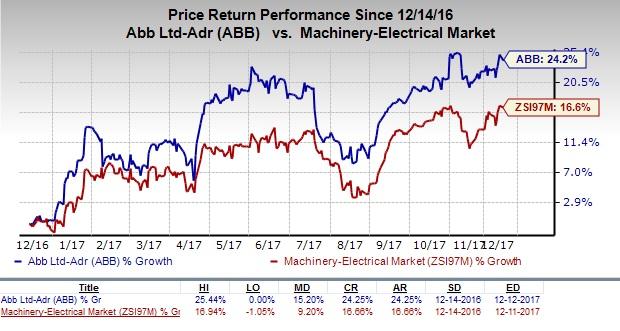

ABB’s shares have fared well in recent times as well, reflecting investor confidence. The company’s shares have appreciated 24.2% over the past year, outperforming the industry’s average gain of 16.6%. Read on to find out the key growth drivers for ABB right now.

Growth Drivers

Steady growth in revenues in the Electrification Products and Robotics & Motion segments has been a key contributor to ABB’s momentum. The Robotics and Motion segment is has been enjoying robust demand patterns in robotics and light industry, while the Electrification Products unit is benefiting from positive construction and utility demand, particularly in the AMEA region.

ABB has earned a solid reputation for winning strategic awards and forging important partnerships. ABB recently teamed up with Hewlett Packard Enterprise to integrate its industry-leading digital offering — ABB Ability — with Hewlett Packard’s innovative hybrid information technology solutions. The partnership will leverage ABB’s expertise in operations technologies (“OT”) and Hewlett Packard Enterprise’s proficiency in IT to come up with joint industry solutions, which will help turn industrial data into insights and automatic action.

ABB also joined forces with Kawasaki Heavy Industries Ltd. recently to share knowledge and promote the benefits of collaborative robots, particularly those having dual arm designs.

We are highly optimistic about ABB’s recent $2.6-billion acquisition of GE Industrial Solutions, which will fortify its global foothold in electrification, and expand the company’s access to the North American market.

Further, the company anticipates the recent B&R buyout to bridge the gap in machine and factory automation, while also generating tremendous operational synergies. ABB anticipates these acquisitions to help shift its focus to higher growth segments, consequently becoming more competitive. ABB also agreed to acquire the data transmission business of the KEYMILE Group in July. This buyout is expected to expand communication networks business footprint in the industrial, transportation and infrastructure domains.

The company is highly positive about the impact of its White-Collar Productivity savings program, which has garnered significant cost savings over the past few quarters. Moreover, positive investments made by all three major markets of the company, namely utilities, industry and transport & infrastructure, are expected to boost the financials, going forward.

The consensus analyst community’s optimism toward the stock is reflected in its upward earnings estimate revisions. The stock has seen the Zacks Consensus Estimate for current-year earnings being revised upward to $1.24 from $1.22 over the past 60 days, and reflects bullish analyst sentiment.

ABB Ltd Price, Consensus and EPS Surprise

Despite these positives, ABB’s exposure to oil and gas markets makes it susceptible to current price volatility in the market, posing a severe challenge. We believe lower capital spending for the upstream energy end-markets might hurt financials as well. In addition to these, sluggish industrial production and the projected slowdown are weighing on the company’s financials. Currently, the industrial slowdown in China is posing another threat to the company’s profitability, and might impact its performance in the upcoming quarters.

Other Stocks to Consider

Some top-ranked stocks in the broader space are Deere & Company (NYSE:DE) , Briggs & Stratton Corporation (NYSE:BGG) and Alamo Group, Inc. (NYSE:ALG) , each sporting a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company generated four outstanding beats over the trailing four quarters, for an impressive average positive surprise of 19.5%.

Briggs & Stratton has beaten estimates thrice in the trailing four quarters, and generated an average positive surprise of 8.6% during the same period.

Alamo Group has a decent earnings surprise history for the same time frame, having beaten estimates twice for an average beat of 6.1%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

ABB Ltd (ABB): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Briggs & Stratton Corporation (BGG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.