The Institute of Supply Management will be releasing its monthly manufacturing PMI report later today. According to economists polled, the manufacturing activity for the US is expected to slow for another month.

Data for June forecasts show that manufacturing PMI will ease to 56.1, down from 56.9 in May. This would mark a decline in the index which managed to remain somewhat volatile over the past few months.

In a separate report released a few weeks ago, data from IHS Markit showed that services activity fell to 50.7. The data missed estimates of 51.0 and was down from May’s print of 50.9.

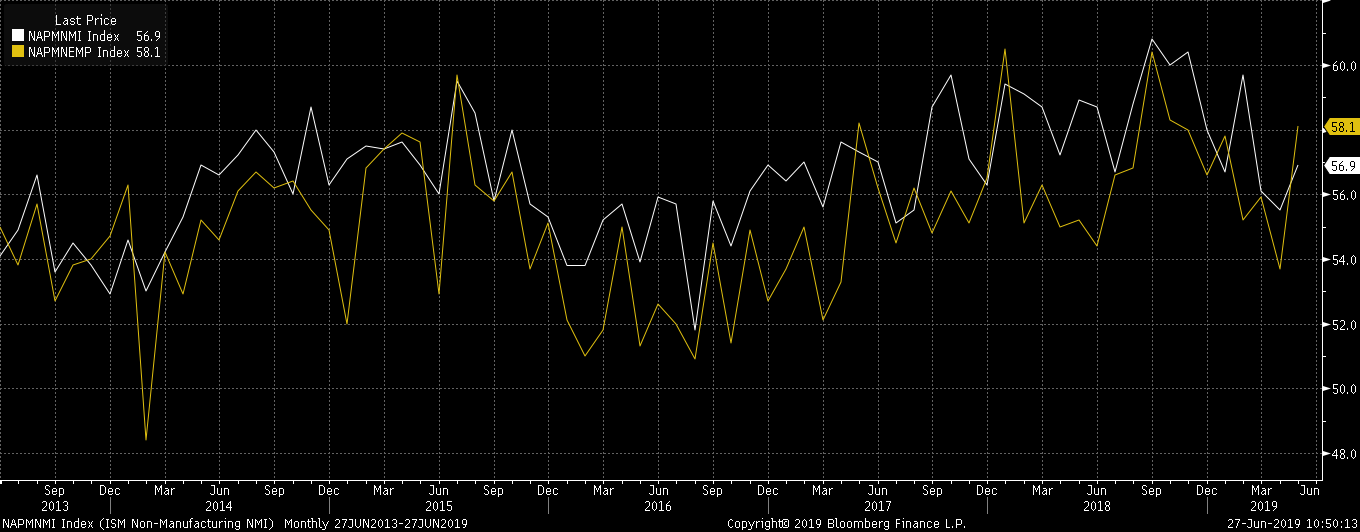

ISM Non-Manufacturing PMI, May 2019

ISM Non-Manufacturing PMI, May 2019

ISM’s non-manufacturing PMI report will be closely watched by investors. This is because of the general expectation that growth could slow in the second quarter of the year.

The report will conclude the data for Q2 and will provide some insights into how the US economy might have fared, at least from the services sector perspective.

ISM Non-Manufacturing Index Rises in May

The non-manufacturing activity as measured by the ISM beat expectations in the month of May. Data showed that activity in the non-manufacturing sector rose to 56.9 in May, comparing to 55.5 in April.

The uptick in the non-manufacturing activity was in contrast to the manufacturing sector which has been in a steady decline for the past three months. The non-manufacturing index PMI was forecast to remain unchanged from May’s levels.

Upon closer observation, data showed that business activity in the services sector rose to 61.2 in May, up from 59.6 in April. This marked a 118th consecutive month of gains in the services sector.

ISM’s non-manufacturing activity ticked higher in May despite the ADP payrolls report signaling a slower pace of job gains in the services sector.

The data was a welcome change after the manufacturing sector grew at the slowest pace in two and a half years. The manufacturing sector is said to be hit due to the trade spat between the US and a number of its trading partners including China.

The full effect of the Trump-led trade wars is expected to be realized starting from the second quarter of this year. Growth is expected to fall below the 3% average growth rate seen previously.

So far, the services sector has managed to be the bright spot in the PMI’s from ISM. A continuation of this trend could potentially soothe investor concerns that the declines might not be as bad as expected.

Will the Index Drop Further?

The outlook for the non-manufacturing PMI remains rather mixed. Global trade uncertainty remains a major issue. However, at the same time, with the Fed signaling its support by potentially cutting rates, it could offset the uncertainty.

The flash estimates from Markit revealed that growth momentum was losing steam. The composite output index for June was at 50.6 comparing to 50.9 in May marking a 40-month low.

According to Chris Williamson, IHS Markit’s chief economist, growth was stagnating in June. The market expects that, based on the flash surveys, the US economy might have grown at a pace of 1.4% in the second quarter of the year.

If this is true, it would mark a less than half pace of growth compared to the first quarter GDP. Business optimism was the most hit during the period, according to IHS Markit’s flash surveys for the month of June.

Investors will, without a doubt, watch the ISM reports coming out this week. The market speculation is for the Fed to cut rates at the July meeting. But Fed Chair Jerome Powell recently cautioned against acting too hastily.

Thus, the economic data over the week, which includes the ISM’s surveys as well as the payrolls report for June, could potentially be a game changer for the Fed.