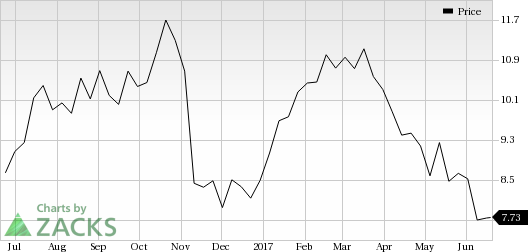

Integrated electric utility, Companhia Paranaense de Energia (NYSE:ELP) or COPEL yesterday announced a hike in its capital expenditure budget for 2017. The day’s trading session ended 0.13% higher at $7.73 per American Depository Receipt.

As revealed, COPEL’s additional capital expenditure budget was approved by the board of directors at its 167th Ordinary Meeting held on Jun 13. The revised budget of R$2,877.5 million represents an increase of 41.4% or R$842.6 million from the original expenditure target of R$2,034.9 million.

Of the revised budget, roughly R$1,024.5 million will be used for the Generation and Transmission business, up around 79.6% from the previously allocated amount. Distribution business capital expenditure budget is R$649.2 million, up roughly 3.1% from the previous amount while budget for the Telecommunications business increased 30.4% to R$214.3 million. Notably, the company has increased expenditure budget of its Cutia Wind Farm Complex by 51.5% to R$967.5 million. The remaining amount will be used for the development of other miscellaneous businesses.

We believe that COPEL’s efforts to improve its electricity generation capabilities and electricity-related services will enable it to capitalize on the growing demand for electricity in its operating areas. In addition, further improvisation in its telecommunication business will bode well for its profitability. Notably, the company plans to provide its telecom services to 85% of cities in the state of Parana by 2024.

COPEL currently has a $1.96 billion market capitalization and is grouped under the Zacks categorized Utility Electric Power industry.

Some stocks worth considering in the industry include RWE AG (OTC:RWEOY) , Algonquin Power & Utilities Corporation (TO:AQN) and Atlantic Power Corporation (NYSE:AT) . While RWE AG sports a Zacks Rank #1 (Strong Buy), both Algonquin Power & Utilities and Atlantic Power Corporation carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RWE AG’s earnings expectations for 2017 and 2018 have improved over the past 60 days. Its five-year earnings growth rate is predicted to be 11.20% compared with 6.40% for the industry.

Algonquin Power & Utilities Corporation performed well in the last quarter, with an earnings surprise of 11.76%. Earnings estimates for second-quarter 2017 have improved in the last 60 days.

Atlantic Power Corporation pulled off an average positive earnings surprise of 98.53% for the last four quarters. Also, earnings expectations on the stock improved for the second quarter and full-year 2017.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Atlantic Power Corporation (AT): Free Stock Analysis Report

RWE AG (RWEOY): Free Stock Analysis Report

Algonquin Power & Utilities Corp. (AQN): Free Stock Analysis Report

Original post

Zacks Investment Research