- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3D Systems Struggling With Demand Issues, Tough Competition

Despite being a market leader, 3D Systems Corporation (NYSE:DDD) has been straining under capricious demand and tough competition in recent times. Let’s delve into the prospects of the industry and how much 3D Systems can capitalize on the same.

3D Systems: As We Know It

In 2016, 3D printer sales growth decelerated, reflecting a slowdown at 3D Systems and Stratasys Ltd. (NASDAQ:SSYS) , the two industry leaders by revenue. The industry’s sales grew by 17.4% in 2016, according to Wohlers Associates — down 26% growth recorded in 2015. The downturn was led by decline in the performance of 3D Systems and Stratasys, which together made up 22% of industry sales last year. Excluding these two market leaders, industry sales rose 25%, per the data.

Likewise, 3D Systems enjoyed rapid growth from 2010 to 2014, but it has since struggled to maintain that rate. Its revenues grew just 1.9% in 2015, and it actually contracted in 2016. A lack of meaningful product roll-outs and streamlining low-margin businesses restricted revenue growth. Further, growth could have become harder to come across as the company became less acquisitive in recent years, and relied largely on organic growth.

In early 2017, we saw some slightly optimistic numbers, as top line grew 3% year over year — driven by improved demand among industrial, healthcare and materials customers. Looking to the future, 3D Systems has guided revenue growth of 2-8% for this year, including about 200 bps contribution from the Vertex acquisition. Effectively, organic growth expectations stand somewhere around 3%, at the mid-point of guidance.

This doesn’t seem so downbeat. However, when you take the company’s current valuation into account, it just might. The company is trading at a trailing 12-month PE Ratio (Price to Earnings ratio) of a whopping 94.30, which is miles ahead of the Zacks categorized Computer-Mini industry’s PE of 16.74. This just seems a bit much for an expected organic growth rate of 3%.

Coming to the operational structure, the company’s relatively new CEO Vyomesh Joshi has been cutting costs all over, but it seems like he has already done most of what’s there to be done. This was reflected in high research & development outlay in the last reported quarter, which contributed to a bottom-line miss.

Industry Prospects

Worldwide 3D printer shipments grew 29% while revenues grew 18%, per IDC’s Worldwide 3D Printer Shipment Tracker data released earlier this week. Third-party research sees the 3D printing market growing at a CAGR of over 20%.

Apparently, investors believe that 3D Systems is well-positioned to capitalize on these robust prospects. The company’s share price has had a great run in recent times, despite sluggish growth and inconsistent earnings. Over the past six months, shares of 3D Systems recorded an average return of 52.4%, miles ahead of the Zacks categorized Computer-Mini industry’s average of 24.5%. We believe that such a sharp price jump, in light of its modest growth expectations, could indicate that the stock has become too rich.

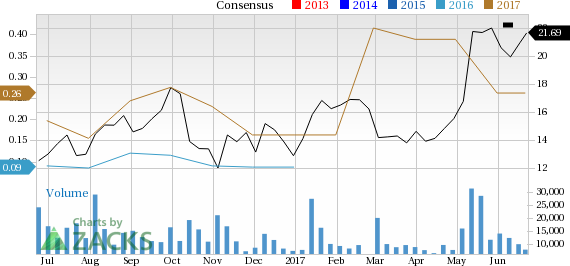

The analyst community is also feeling apprehensive about this Zacks Rank #4 (Sell) stock as its earnings estimates continue to move south, reflecting decidedly pessimistic sentiment. 3D Systems’ Zacks Consensus Estimate for full-year 2017 has plunged from 39 cents a couple of months ago to 26 cents today, on the back of six downward estimate revisions versus none upward. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3D Systems Corporation Price and Consensus

The Big Ones

Meanwhile, the entry of HP Inc. (NYSE:HPQ) and General Electric Company (NYSE:GE) has shaken things up in the industry. While GE is fast acquiring firms & technology to get a foothold in the space, HP Inc. is focusing on mass production.

The 3D printer market was taken aback last year as GE spent over $1 billion on two acquisitions. The company is on the lookout for more acquisitions to expand its foothold in the burgeoning business. In fact, the industrial conglomerate expects to generate $1 billion in revenue from 3D printing activities by 2020.

Hp Inc. recently announced that it will launch a $130,000 printer later this year — and claims that the printer can make parts at half the cost and at least 10 times faster than rival printers. This could be a huge competitive blow to 3D Systems. In fact, the company is already feeling the pressure as customers delay purchases to assess new products from companies like HP Inc.

Nevertheless, there is no doubt that HP Inc. will help expand the market for 3D mass production, while GE’s aggressive steps will likely lead to quicker adoption of the machines across the industrial sector. In fact, Wohlers Associates projects the market to expand to $26.2 billion, by 2022. Whether 3D Systems can manage to retain a meaningful chunk of that market, remains to be seen.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more.

Click here for a peek at this private information >>

HP Inc. (HPQ): Free Stock Analysis Report

3D Systems Corporation (DDD): Free Stock Analysis Report

General Electric Company (GE): Free Stock Analysis Report

Stratasys, Ltd. (SSYS): Free Stock Analysis Report

Original post

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.