A stronger and more resilient United States—does that mean higher oil prices? Probably so. That means fewer oil company bankruptcies, which is great.

But those firms producing just natural gas, or primary NG, could be in for another world of hurt in terms of continued weak profitability. The continuous prompt-month of US Henry Hub natural gas continues to trade near 25-year lows despite a very hot July.

Natural gas production continued to generally climb off its May lows as oil prices march higher. The narrative seems to be that a stronger economic outlook/optimism means higher oil prices, which means more oil and gas production, which then means lower natural gas prices. It sounds nice, but we’ll see if that indeed plays out the rest of the year.

Texas has reported 106 bankruptcies from energy firms this year alone, easily the most of any state—and a whopping total. Nevertheless, oil near $40 is high enough to sustain the operations of many existing wells across the country. As such, a good chunk of associated gas has returned in the last two months.

Putting some numbers to the story, dry gas production ticked up above 87 Bcf/day late last week before settling back into the 86.5-87.0 Bcf/day range. The EIA still expects natural gas production to move lower during the second half of the year and into Q2 2021.

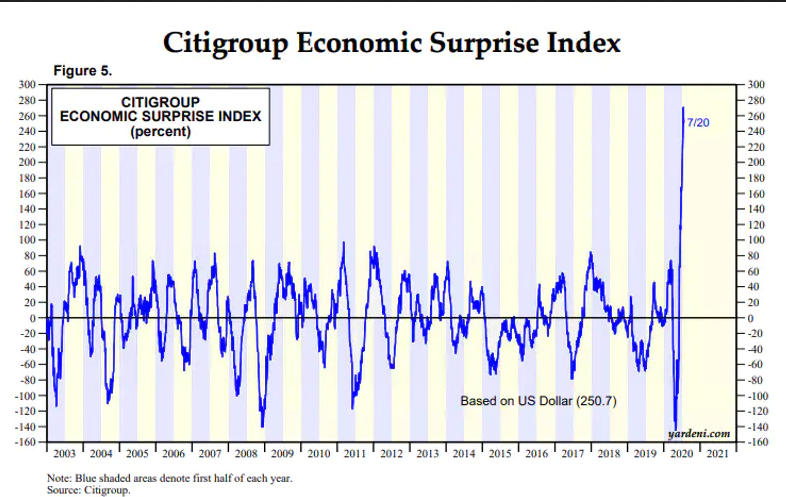

Regarding the US economy, the Citi Economic Surprise Index is near its highest levels ever, which means the economy is recovering faster than what analysts had expected. Corporate earnings season is just getting started, but so far earnings are coming in better than forecasts, too, and slightly better than the historical average beat rate.

The US Federal Reserve remains very accommodative and Congress may extend unemployment benefits beyond the current end of the month expiration date.