- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3D Systems Affected By Surging Costs & Macroeconomic Woes

3D Systems Corporation (NYSE:DDD) continues to struggle with the headwinds that have marred its performance over the past few quarters. We anticipate that a continuous rise in operating expenses, among other factors, will continue to hinder growth for the company. Moreover, in light of its miserable third-quarter 2017 results and uncertain operating environment, the company’s management withdrew full-year 2017 guidance.

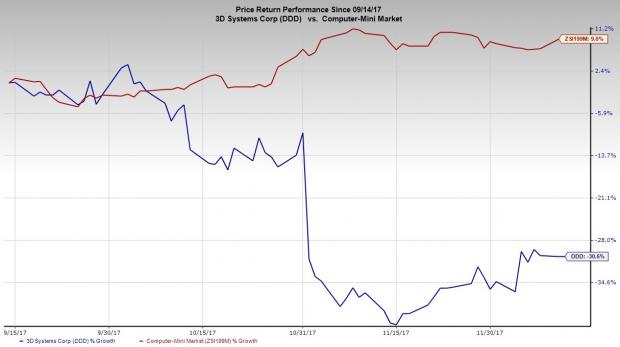

It’s not surprising that the stock has also put up a dismal show in recent times. In the past three months, 3D Systems has lost 30.5% against the industry’s growth of 9%. Further, the Zacks Consensus Estimate for 2017 earnings has moved south over a couple of months from 44 cents to a loss of 4 cents. This indicates exceedingly bearish analyst sentiment, reflected by five downward estimate revisions versus none upward.

Read on to find the major factors curbing the Zacks Rank #5 (Strong Sell) company’s growth and why it may be prudent to avoid the stock at the moment.

Factors at Play

3D Systems had commenced significant transformational work in solving legacy issues in the third quarter, which partly led to the company withdrawing guidance for 2017. The company cited that it is unable to predict earnings and sales numbers accurately. This action has unnerved investors badly, as it indicates a highly uncertain environment.

During the third quarter, revenues from 3D printing products and services were significantly undermined due to continued challenging market conditions that adversely impacted customers' capital investment cycles and reduced demand across most geography. Further, its performance in Americas and Asia Pacific was very weak. If these problems persist, 3D Systems’ earnings will likely continue to be under pressure, going forward as well.

Also, the company continues to incur high research & development (R&D) and acquisition costs. Going forward, the company believes investment in IT and go-to-market initiatives will result in higher expenses, consequently restricting near-term operating income growth. During third quarter, the company had legal expenses from a Department of Commerce investigation, which inflated costs. We expect margin contraction and higher operating expenses in the upcoming quarters as 3D Systems attempts to implement organizational changes.

Moreover, over the past few quarters, the company has been experiencing unfavourablebroader market conditions that have badly hit its financial performance. Macroeconomic factors such as economic slowdown, inflation, currency fluctuations, commodity prices and credit availability have negatively impacted performance. This apart, the company’s business faces the adverse effects of rapid technological changes, alterations in user and customer requirements and preferences, consequently adding to challenges.

Thus, considering the risks that the company faces, we believe it would be prudent for investors to avoid the stock for now.

Stocks to Consider

Some better-ranked stocks from the same space include Axcelis Technologies, Inc. (NASDAQ:ACLS) , Amphenol Corporation (NYSE:APH) and A10 Networks, Inc. (NYSE:ATEN) . While Axcelis Technologies sports a Zacks Rank #1 (Strong Buy), Amphenol and A10 Networks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axcelis Technologies has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 25.2%.

Amphenol has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 8.9%.

A10 Networks has outpaced estimates in the preceding four quarters, with an average earnings surprise of 111.1%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

3D Systems Corporation (DDD): Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

A10 Networks, Inc. (ATEN): Free Stock Analysis Report

Amphenol Corporation (APH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.