- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Secret Social Media Stocks

Do you still sign on to your e-mail account to send messages to friends? If you do, you're probably over the age of 30.

According to a recent article in the New York Times, the next generation, especially college students, find e-mail to be "boring" and don't use it on a daily basis. College professors have had to make it a requirement that students check their e-mail every day in order to get students to use it. What do college students use to communicate? Text and social media.

According to the New York Times, Reynol Junco, an associate professor of library science at Purdue, tracked students computer habits and discovered that during a semester they spent an average of 123 minutes a day on a computer. The largest portion, by far, was on social media, which ate up 31 minutes.

E-mail and looking for content via search engines like Google (GOOG) came in at the least amount of time. Content searching took up just 4 minutes.

All those parents who are reserving their newborn child's name on Google's gmail, might be doing it for naught.

People are using private messaging on Facebook to message groups of friends and Twitter to make weekend plans. Who hasn't seen the tweets that say, "I'm coming into town this weekend. Who wants to get together?" sent to friends or followers for all to see?

Communication via social media is quickly replacing e-mail the same way e-mail replaced paper letters.

What is Social Media?

A lot of different companies get lumped into "social media."

According to Wikipedia, social media is defined as the "means of interactions among people in which they create, share, and/or exchange information and ideas in virtual communities and networks."

Obvious examples of social media companies include Facebook, LinkedIn, Yelp and TripAdvisor. When Twitter goes IPO later this year, it will rival Facebook and LinkedIn in global reach and scope.

But there are other companies that are not on everyone's radar but that are players in the social media space. Investors should be keeping these in mind as a way to play the social media space.

3 Secret Social Media Stocks

1. SINA

2. MeetMe, Inc.

3. IAC

1. SINA (SINA)

SINA may not be a "secret" but with Twitter and Facebook (FB) restricted in China, it would be wrong to overlook the Chinese social media leaders.

SINA is a Chinese online media company which operates SINA.com, which provides entertainment and information, and Weibo.com, a popular microblogging site which is China's equivalent of Twitter.

In the second quarter, revenue rose 20% year over year. SINA is leveraging Weibo's traffic growth to develop social and mobile advertising. In the quarter, Weibo advertising grew 209% to $30 million, but that is still far under the total advertising revenue in the quarter of $120.6 million.

Earnings are predicted to grow 157% in 2013 but it's still expected to make just $0.08. In 2014, analysts see significant gains, however, as earnings are forecast to jump 1668% to $1.42.

Still, with shares soaring over the summer, it is trading with a nosebleed P/E of 1014. It's clearly a bet on the future. SINA is a Zacks Rank #3 (Hold).

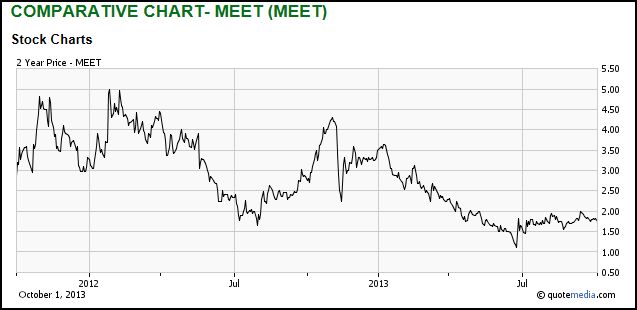

2. MeetMe, Inc. (MEET)

MeetMe is a micro-cap company that makes social games and apps. Headquartered in Pennsylvania, 60% of traffic comes from mobile. It operates MeetMe.com and MeetMe apps on iPhone, iPad and Android in multiple languages.

In the second quarter its revenue jumped 21.5% to $9.5 million. Mobile revenue was at an all-time high of $2.6 million, up 98% year over year.

Still, the company saw a loss of $0.05 a share in the quarter. It isn't expected to be profitable in 2013 but is forecast to see a $0.02 profit in 2014.

MeetMe is a Zacks Rank #3 (Hold).

Shares have actually been sinking in 2013.

3. IAC (IACI)

Many of you may be familiar with IAC's brand of websites and not even know it. IAC is a media and Internet company with more than 150 brands and is the leader in online dating with Match.com, OkCupid, OurTime.com, Meetic and ParPerfeito and an investment in Zhenai, a leading matchmaking company based in China.

It also owns About.com, HomeAdvisor.com and Vimeo.com. It gets a billion monthly visits from 30 countries.

In the second quarter, IAC beat the Zacks Consensus Estimate by 2 cents as revenue rose 17% year over year. It was the second consecutive earnings beat.

Earnings are expected to be up big in 2013, rising by 82.3%. In 2014, analysts still see double digit growth of 16.5%.

Shares have been on fire in 2013, hitting a 2-year high. But they trade with an attractive valuation of 15.9x. IAC is a Zacks Rank #3 (Hold).

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.