- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Reasons To Buy First Of Long Island Corporation Stock Now

Improving operating backdrop, rising rate environment, expectations of lesser regulations and lower tax rates, and strengthening of the domestic economy are expected to continue supporting banking stocks. Keeping this in mind, we have selected The First of Long Island Corporation (NASDAQ:FLIC) for your consideration.

A positive trend in estimate revisions reflects optimism regarding the company’s earnings growth prospects. The Zacks Consensus Estimate for First of Long Island Corporation’s current-quarter earnings has moved up 5.6% over the last 60 days. Also, the current-year’s earnings estimates have climbed up 1.4% in the same time period.

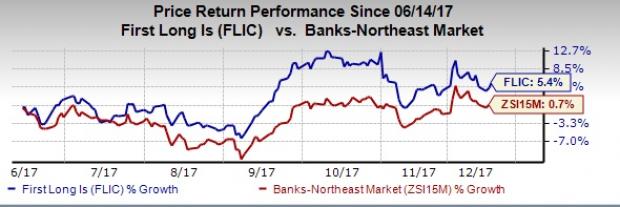

Furthermore, this Zacks Rank #2 (Buy) stock has surged 5.4% over the past six months, widely outperforming the industry’s 0.7% rally.

Here’s What Might Drive the Stock Higher

Earnings Strength: While First of Long Island Corporation’s historical earnings per share (EPS) growth rate of 8.2% compares unfavorably with the industry average of 8.5%, investors should really focus on its projected EPS growth (F1/F0). Here, the company is looking to grow at a rate of 11.9%, higher than the industry average of 10.5%.

Revenue Growth: The company has been witnessing consistent improvement in revenues for the past few years. Revenues witnessed a compound annual growth rate of 13.2% over the last three years (2014-2016). Further, the top line is expected to increase 11.5% in 2017 compared with no growth for the industry.

Favorable ROE: First of Long Island Corporation’s return on equity (ROE) supports its growth potential. It’s ROE of 10.81% compares favorably with the industry average of 8.67%, implying that it is efficient in using its shareholders’ funds.

Other Stocks to Consider

Some other top-ranked stocks from the same space are ConnectOne Bancorp (NASDAQ:CNOB) and CNB Financial (NASDAQ:CCNE) sporting a Zacks #1 Rank (Strong Buy), and First Commonwealth Financial (NYSE:FCF) carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

ConnectOne Bancorp’s Zacks Consensus Estimate was revised 13.6% upward for the current year, in the last 60 days. The company’s share price increased 11.3% in the past six months.

CNB Financial witnessed an upward earnings estimate revision of 4.4% for the current year, in the last 60 days. Its share price rose 16.3% in the past six months.

First Commonwealth Financial witnessed upward earnings estimate revision of 2.5% for the current year, in the last 60 days. Its share price moved 10% upward in the past six months.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

CNB Financial Corporation (CCNE): Free Stock Analysis Report

The First of Long Island Corporation (FLIC): Free Stock Analysis Report

First Commonwealth Financial Corporation (FCF): Free Stock Analysis Report

ConnectOne Bancorp, Inc. (CNOB): Free Stock Analysis Report

Original post

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.