- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

After Tremendous Drop, Oil Establishes Range

After a tremendous drop, crude oil seems to be establishing a range.

I think this continues for some time, as the large oil-producing countries work together to stabilize prices. The current price already reflects the slower growth in China and other developing countries.

Long term I am bullish on oil, as it is not profitable for many of the producers at these levels. As investment drops, supply will follow. Once these producers are out of the market, I also believe OPEC producers will cutback in output, causing more upward pressure on oil prices.

I would look to sell out of the money put options on the United States Oil Fund ETF (N:USO), to capitalize on this trend.

This strategy does have risks. Keep in mind oil has been very volatile recently. It has gone from 60 USD/bbl last May, to 31 USD/bbl today. By selling options, you take on more risk then buying or selling the underlying, since options involve the use of leverage. Keep in mind, each contract represents 100 shares of the underlying. However, the out of the money options have a relatively high implied volatility. So, you are being paid to take that risk.

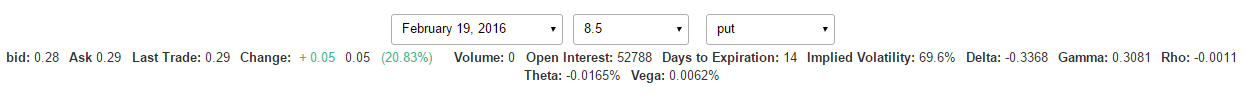

Having said that, I am looking specifically at selling the 8.50 February 19th puts. USO is trading at 8.91 right now. These puts are trading at 0.29. You can see that the implied volatility is 69.6% vs. a historical volatility of 43.6% of the underlying. A higher implied volatility equals a higher premium, resulting in more income from selling puts.

If you sell 10 of these options, you will receive a premium of $290.

If USO is below 8.50 at expiration, you end up having to buy 1,000 shares at 8.50. Which would be an effective price of 8.21 (8.50 minus the 0.29 premium). If USO is is above 8.50 at expiration, you keep the premium. Not a bad deal either way.

Related Articles

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Oh man, can President Trump’s leadership move markets. President Trump’s deal-making and negotiating skills are changing the hearts and minds of world leaders as he leaves his...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.