Equities and risk linked assets started the week on a positive note following reports that Moderna's (NASDAQ:MRNA) coronavirus vaccine was 94.5% effective in preventing coronavirus infections. Overnight, we also got the minutes from the latest RBA meeting, which revealed that policymakers remain willing to do more if needed. With regards to the Brexit saga, UK chief Brexit negotiator Frost told PM Johnson to expect a trade deal early next week.

Moderna Follows Pfizer In Reporting Vaccine Effectiveness

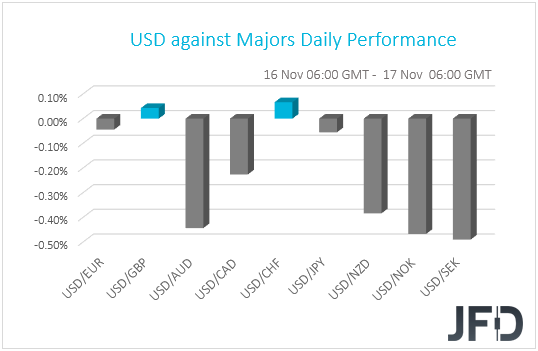

The US dollar traded lower against the majority of the other G10 currencies on Monday and during the Asian session Tuesday. It lost the most ground versus SEK, NOK, AUD and NZD, while it underperformed the least against JPY and EUR. The greenback eked out some gains only versus CHF and GBP.

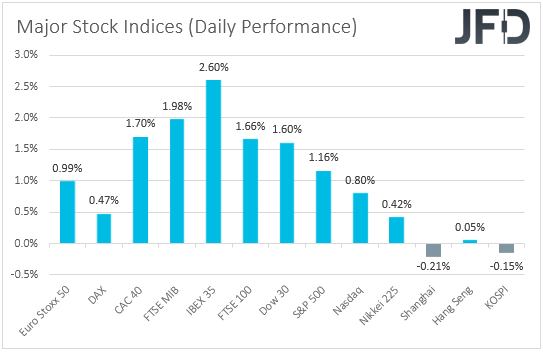

The relative weakness in the safe-havens dollar, yen and franc, combined with the strengthening of the risk-linked Aussie and Kiwi, suggests that markets continued trading in a risk-on fashion. Indeed, turning our gaze to the equity world, we see that major EU and US indices were a sea of green.

That said, investors’ appetite softened during the Asian session today. Although Japan’s Nikkei 225 gained 0.42%, Hong Kong’s Hang Seng is trading virtually unchanged, while China’s Shanghai Composite and South Korea’s KOSPI are down 0.21% and 0.15% respectively.

The driver behind the further improvement in investors’ appetite was headlines that Moderna’s coronavirus vaccine was 94.5% effective in preventing coronavirus infections. Moderna is the second drugmaker to report promising trial data, following Pfizer (NYSE:PFE) last week, which said that its vaccine was more than 90% effective.

This brings us another step closer in finding the cure for the virus, and although the covid-era is not behind us yet, the more companies reporting promising results with regards to their vaccines, the more optimistic investors may be. Thus, we still believe that risk appetite could continue being supported, with equities and other risk-linked assets being benefited. At the same time, safe havens, like the dollar, the yen and the franc, may stay under selling interest.

Now, apart from developments surrounding a potential coronavirus vaccine, overnight, the RBA released the minutes from its latest monetary policy gathering. The minutes confirmed Governor Lowe’s remarks that further rate cuts are unlikely, but revealed that officials stay prepared to do more if needed, focusing on bond purchases.

Despite the Bank’s readiness to act again if necessary, the Aussie barely reacted to the minutes, confirming our view that the risk-linked currency will stay mostly driven by developments surrounding the broader market sentiment. Indeed, it was found among the main G10 gainers this morning. Conditional upon more risk-on trading, we see the case for a stronger Aussie in the near term.

Now, flying from Australia to the UK, although the pound was among the two currencies that lost ground against the US dollar, it was somewhat boosted overnight by reports saying that UK chief Brexit negotiator David Frost told Prime Minister Johnson to expect a trade deal with the EU early next week. Frost said that he has pinpointed “a possible landing zone” as soon as next Tuesday, but warned that talks could still collapse.

Remember that recently we’ve been highlighting that the British currency is likely to stay mostly linked to developments surrounding the Brexit landscape and all this adds credence to our view. Therefore, we will stick to our guns that anything pointing towards an accord may prove supportive for the pound, while the opposite may be true if news suggests that the two sides are finding it difficult to reach common ground.

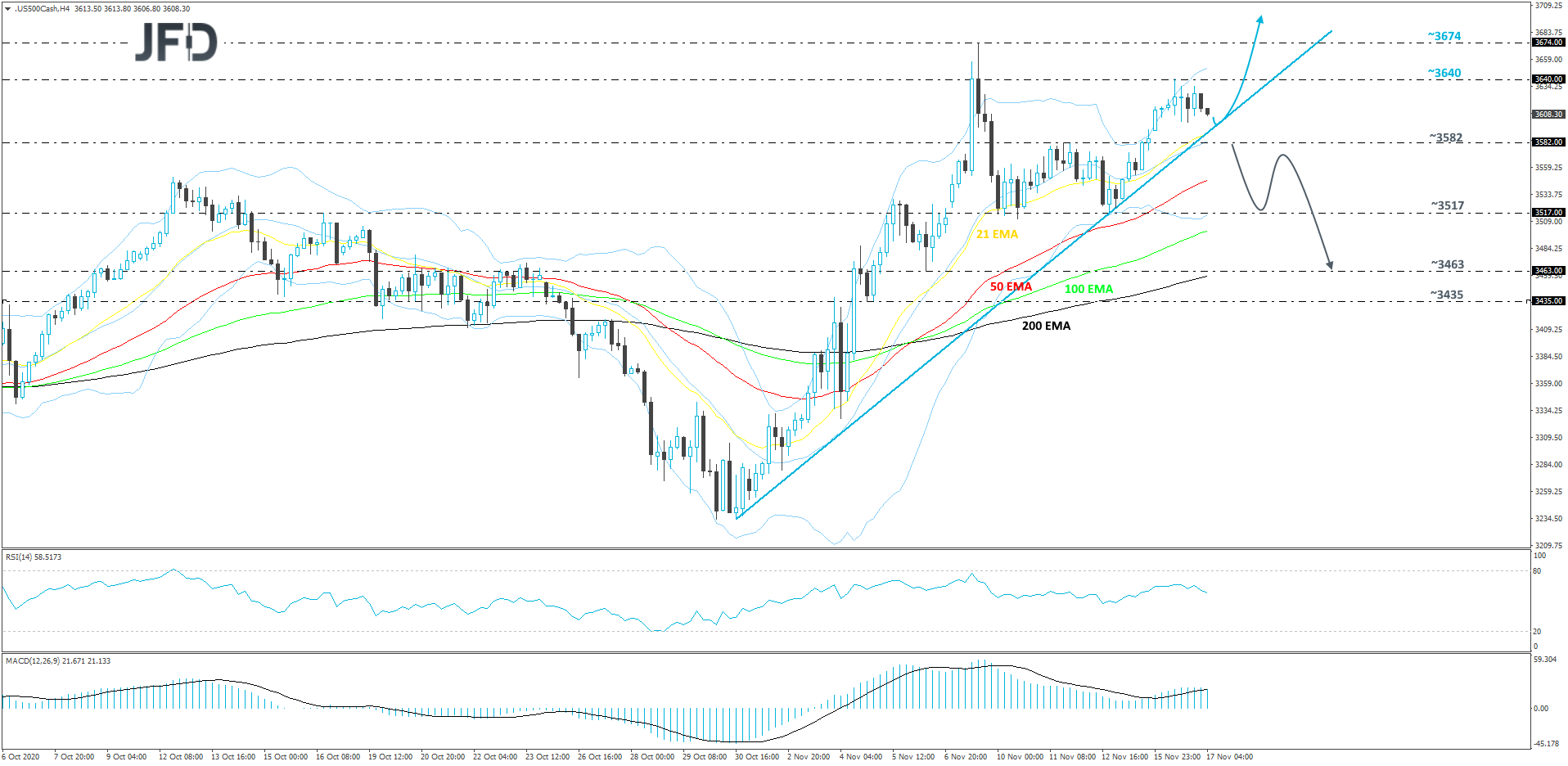

S&P 500 Technical Outlook

The S&P 500 continues to run above its short-term tentative upside support line taken from the low of Oct. 30. Yesterday, the index found resistance near the 3640 barrier. We are currently seeing a slight correction on the cash index, however, if the price remains above that upside line, we will continue targeting the upside.

As mentioned above, a small move lower could bring the price back down to test the aforementioned upside line, which if stays intact, may attract the buyers back into the arena. All that might help lift the index up again and send the S&P 500 to yesterday’s high, at 3640. A break of that area could open the door for a possible test of the all-time high, which was reached last week, at 3674. If the buyers are still feeling quite comfortable, they may overcome that barrier and place the index into the uncharted territory again.

On the downside, if the rate breaks the aforementioned upside line and then slides below the 3582 hurdle, which is the high of Nov. 11, that could clear the way to the 3517 zone. That zone is marked near an intraday swing low of Nov. 10 and the low of Nov. 12, which might provide a bit of a hold-up for the S&P 500. That said, if the sellers see that area only as a temporary obstacle on their way lower, a break of that zone may set the stage for a drop to the 3463 level, marked by the low of Nov. 6.

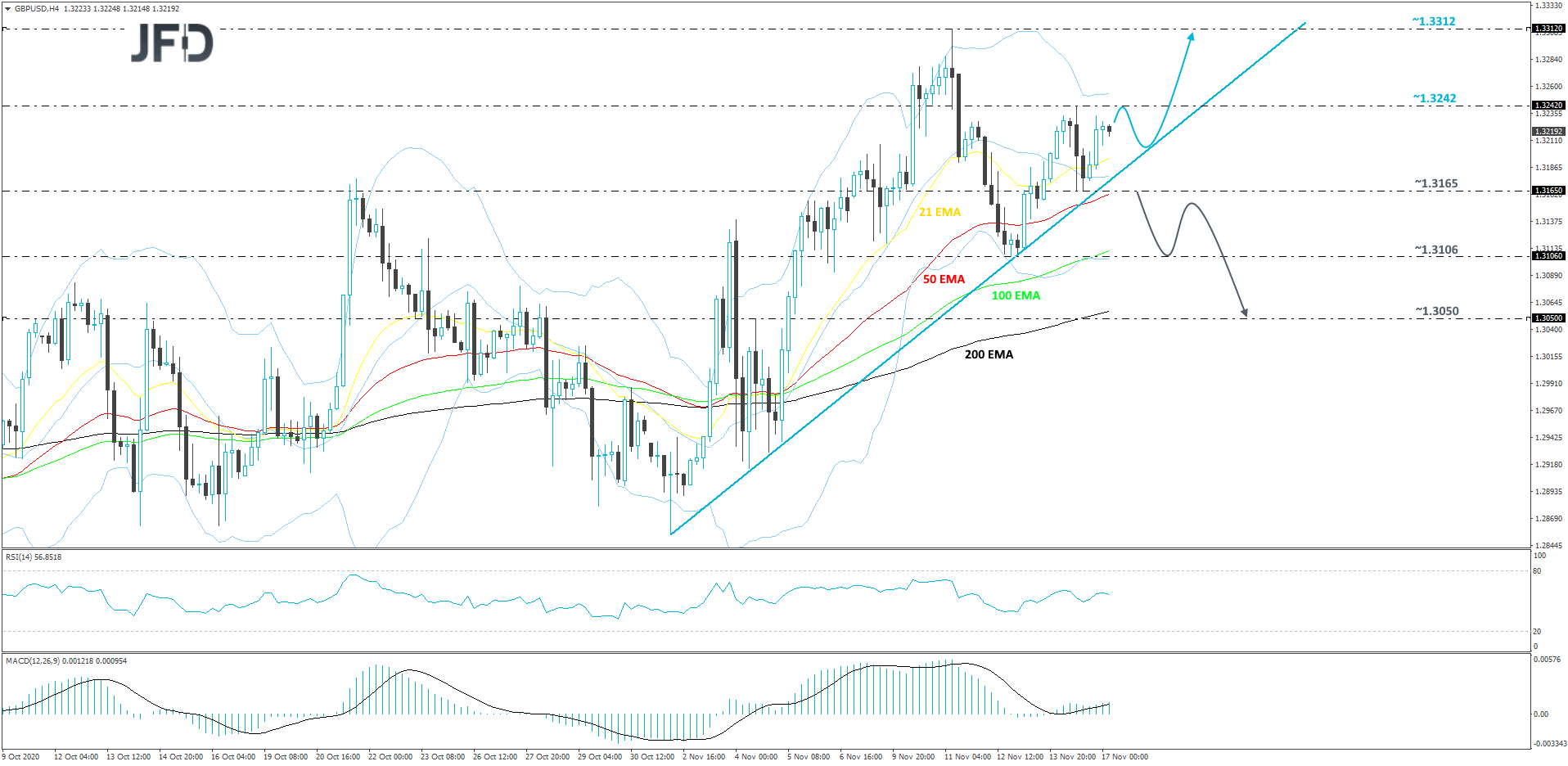

GBP/USD Technical Outlook

Although we have recently seen a small setback on GBP/USD, the pair continues to balance above its short-term upside support line drawn from the low of Nov. 2. As long as the rate remains above that upside line, we will stay bullish, at least with the near-term outlook.

GBP/USD could make its way higher towards yesterday’s high, at 1.3242, where it might get halted again. If so, a small retracement back down might be possible. However, as we mentioned above, if the previously discussed upside line remains intact, this may result in another upmove. If this time the bulls are able to push the rate above the 1.3242 hurdle, the next potential target might be at 1.3312. That area is marked by the current highest point of November.

Alternatively, if the pair moves below the aforementioned upside line and then also drops below the 1.3165 zone, marked by the low of Nov. 16, that might spook the bulls from the field temporarily. GBP/USD could then travel to the low of last week, at 1.3106, a break of which may set the stage for a move to the 1.3050 level, marked by an intraday swing high of Nov. 4 .

As For The Rest Of Today's Events

We get the US retail sales and industrial production, both for October. Both headline and core sales are forecast to have slowed to +0.5% mom and +0.6% mom from +1.9% and +1.5% respectively. With regards to the industrial production, it is expected to have rebounded 1.0% mom after sliding 0.6%. The API weekly report on crude oil inventories is also coming out, but as it is always the case, no forecast is available.

As for the speakers, we have 8 on today’s agenda. From the ECB, we have President Christine Lagarde and Vice President Luis de Guindos, while from the BoE, we have Governor Andrew Bailey and MPC member David Ramsden. As for the Fed, we will get to hear from Atlanta President Raphael Bostic, San Francisco President Mary Daly, and New York President John Williams. BoC Governor Tiff Macklem will also speak.