For the 24 hours to 23:00 GMT, GBP fell 0.37% against the USD and closed at 1.6535, as the latter advanced after the US Fed policymakers decided to trim the size of the central bank’s stimulus package by another $10 billion and after the Fed Chief, Janet Yellen signalled the possibility for an interest rate hike by the middle of next year.

However, earlier during the day, the British Pound rose after an official report showed that number of claiming jobless benefits declined by 34,600 in February, compared to a 33,900 decline registered in the preceding month. Separately, the ILO unemployment rate in the UK came in unchanged at previous month’s level of 7.2% in the three months to January, broadly in-line with market expectations. Meanwhile, the minutes from the Bank of England’s (BoE) latest policy meeting highlighted policymakers’ optimism on the recovery of the UK economy and revealed that all the officials voted unanimously to keep the central bank’s benchmark interest rate unchanged at a record-low 0.5%. The minutes also indicated the policymakers’ dissent over the level of spare capacity in the UK economy and its ability to expand without pushing inflation higher. Furthermore, the BoE officials also noted a further strength in the UK Sterling would put downward pressure on inflation and acknowledged that this steady rise in GBP was mainly driven by “improved optimism regarding growth in the United Kingdom relative to its major trading partners”

The British Pound continued its upward trend after Chancellor of the Exchequer, George Osborne while presenting the UK Budget for fiscal year 2014/15 indicated that the UK economy will register more-than-expected growth this year and that the nation was on track to make a strong recovery if all measures were followed.

In the Asian session, at GMT0400, the pair is trading at 1.6541, with the GBP trading marginally higher from yesterday’s close.

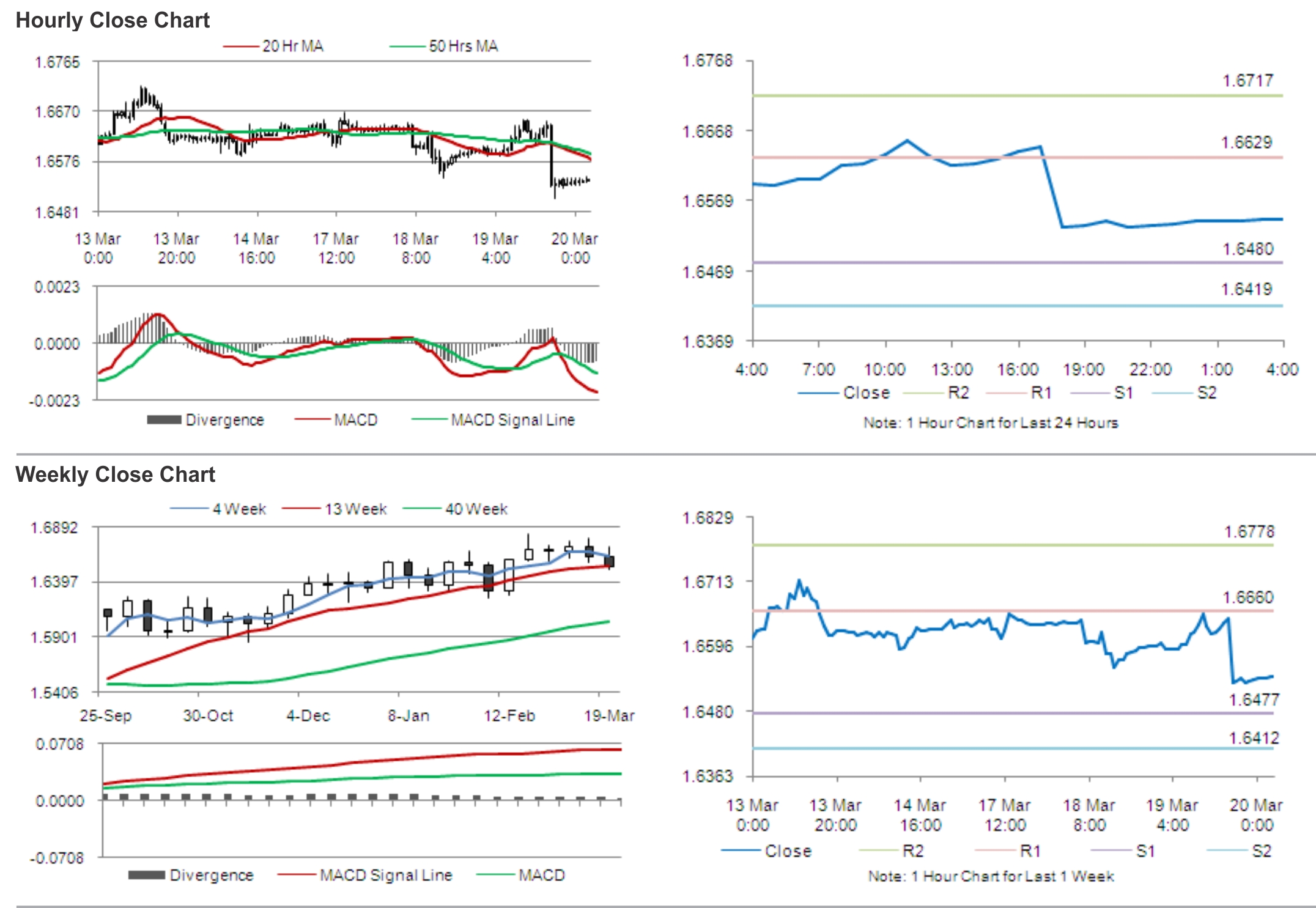

The pair is expected to find support at 1.6480, and a fall through could take it to the next support level of 1.6419. The pair is expected to find its first resistance at 1.6629, and a rise through could take it to the next resistance level of 1.6717.

Later today, the Confederation of British Industry (CBI) is expected to publish a report on the UK industrial trends survey – orders for March.

For the 24 hours to 23:00 GMT, GBP fell 0.37% against the USD and closed at 1.6535, as the latter advanced after the US Fed policymakers decided to trim the size of the central bank’s stimulus package by another $10 billion and after the Fed Chief, Janet Yellen signalled the possibility for an interest rate hike by the middle of next year.

However, earlier during the day, the British Pound rose after an official report showed that number of claiming jobless benefits declined by 34,600 in February, compared to a 33,900 decline registered in the preceding month. Separately, the ILO unemployment rate in the UK came in unchanged at previous month’s level of 7.2% in the three months to January, broadly in-line with market expectations. Meanwhile, the minutes from the Bank of England’s (BoE) latest policy meeting highlighted policymakers’ optimism on the recovery of the UK economy and revealed that all the officials voted unanimously to keep the central bank’s benchmark interest rate unchanged at a record-low 0.5%. The minutes also indicated the policymakers’ dissent over the level of spare capacity in the UK economy and its ability to expand without pushing inflation higher. Furthermore, the BoE officials also noted a further strength in the UK Sterling would put downward pressure on inflation and acknowledged that this steady rise in GBP was mainly driven by “improved optimism regarding growth in the United Kingdom relative to its major trading partners”

The British Pound continued its upward trend after Chancellor of the Exchequer, George Osborne while presenting the UK Budget for fiscal year 2014/15 indicated that the UK economy will register more-than-expected growth this year and that the nation was on track to make a strong recovery if all measures were followed.

In the Asian session, at GMT0400, the pair is trading at 1.6541, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.6480, and a fall through could take it to the next support level of 1.6419. The pair is expected to find its first resistance at 1.6629, and a rise through could take it to the next resistance level of 1.6717.

Later today, the Confederation of British Industry (CBI) is expected to publish a report on the UK industrial trends survey – orders for March.

- See more at: http://forexnews.gcitrading.com/currencies/gbpusd/gbpusd-uk-claimant-count-change-fell-in-february-while-the-ilo-unemployment-rate-came-in-unchanged-in-the-three-months-to-january.htm#sthash.kos27dAr.dpuf