Last week saw the euro dollar buoyed by the weaker than expected rhetoric emanating from the Federal Reserve. The subsequent rally has reignited a bullish sentiment for the pair but the question remains as to whether the euro will continue to challenge resistance in the week ahead.

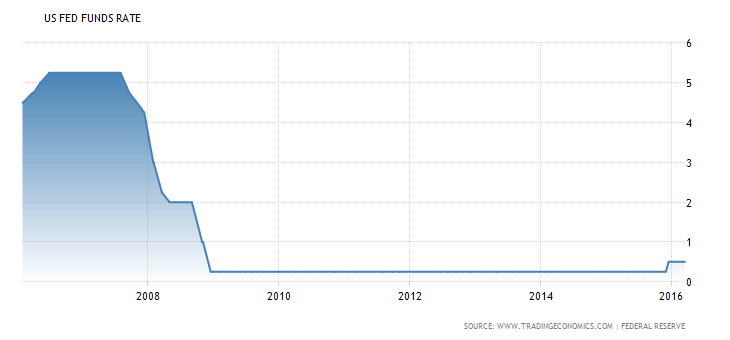

The euro was strongly bullish through last week following the US Fed’s FOMC decision and the subsequent dovish statement. Although it was largely no surprise that the Federal Reserve held the FFR steady at 0.50%, statements following the meeting suggested that the Fed would now only focus on two rate cuts for 2016. This surprisingly dovish rhetoric sent the euro soaring and saw the pair breaking through the key 1.12 handle. In addition, the Eurozone Industrial Production figures also helped the rally, coming in at 2.1% m/m (-1.0% prev).

Looking ahead, the euro is likely to remain relatively buoyant given the ongoing negative USD sentiment sweeping the market. In addition, the Eurozone Manufacturing and Services PMI figures are due out and likely to also provide some trend direction given their forecasts of growth. However, also keep a close watch on the US Unemployment claims data as any demonstrated strength could impede the current bullish trend.

From a technical perspective, the pair remains relatively buoyant, despite a pullback towards the end of last week’s session. Price action has recently formed a new top just above the 1.13 handle and remains significantly above the 100-day moving average. In addition, RSI is trending strongly higher, within neutral territory, but is coming close to over-bought. Subsequently, our bias remains cautiously bullish given the technical indicators and ongoing sentiment swing against the US Dollar. However, monitor the pair carefully for any short term correction pull backs.

Ultimately, the euro is likely to continue challenging the upside in the coming days given the strength of the bullish setup. Subsequently, expect the pair to trade between 1.1250 and 1.1375 levels in the coming week with a predilection towards the top end of the range. However, keep a close watch on the EUR ZEW Economic Sentiment figures, due shortly, as a surprise is likely to impact the pair.