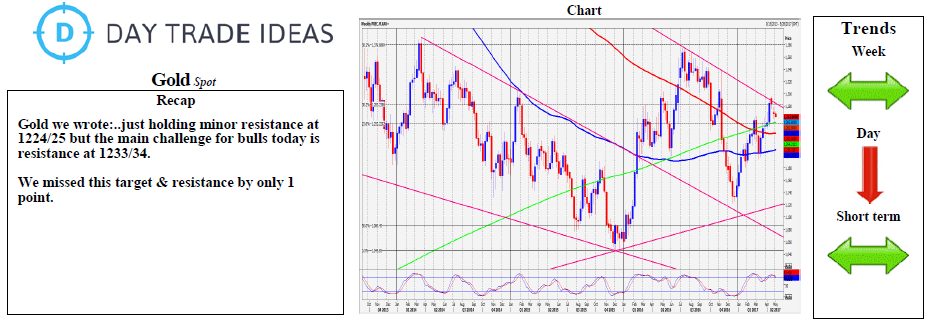

Gold key to direction is resistance at 1233/34. If we have just seen the low for the 1 month correction then shorts here will be risky of course as bulls gain control. If you decide to try, stop above 1238. A break higher however sees 1234/33 act as strong support targeting a better selling opportunity at 1244/45, with stops above 1251.

Failure to beat resistance at 1233/34 again today targets 1229 and the best short term support for today at 1224/23. Below here, 3 month trend line support, now at 1216/15 has made a low for the 1 month correction as we suspected in such severely oversold conditions and is likely hold again this week if tested so worth trying longs. It is only a break below 500 day and 100 week moving averages at 1209/07 that needs to trigger stops on longs and acts as a sell signal initially targeting 1197/95.