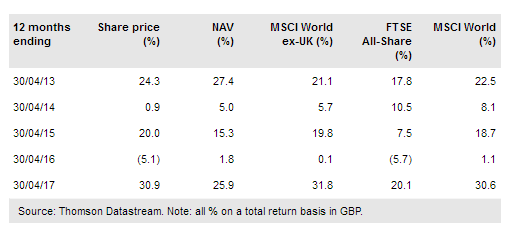

Henderson International Income Trust PLC (LON:HINT) seeks to provide investors with more diversified sources of income, by investing exclusively outside the UK. Managed by Ben Lofthouse, the trust received a significant boost to its assets in 2016 when it was selected as a rollover vehicle for Henderson Global Trust (HGL). Demand has remained strong, and HINT has recently raised a further £21.5m through a ‘C’ share issue, with the new shares listed on 8 May. The manager focuses on well-managed companies with strong competitive positions and sustainable dividends in order to secure income and long-term capital growth. Absolute performance has been favourable, with annualised NAV and share price total returns of 10%+ since launch in 2011.

Investment strategy: Sustainable income and growth

HINT’s manager, Ben Lofthouse (with input from Henderson’s global equity income team), seeks to hold a portfolio of c 65 stocks with dividend yields above 2% and strong cash flow generation to support sustainable dividend growth. The trust invests outside the UK across three regions – the Americas; Europe, the Middle East and Africa; and Asia–Pacific (including Australasia). Lofthouse favours companies with strong management teams, good competitive positions and undemanding valuations, and aims to achieve a high and growing income as well as long-term capital growth potential.

To read the entire report Please click on the pdf File Below